Diverging cattle and sheep markets

After a period of fluctuation, sheep and lamb prices have tumbled. However, unlike the sheep market, cattle prices are unmoved and continue to be reported at or close to record levels. Why the divergence in prices across species?

The impact of COVID-19

A holistic assessment points to the impact of COVID-19 on foodservice demand for Australian sheepmeat as the main drag on domestic lamb prices, at a time when prices would ordinarily be reaching their seasonal peak.

As to the impact of COVID-19 on foodservice demand for Australian beef, widespread restrictions and lockdowns have also been detrimental to overseas demand. However, the winter supply contraction, market diversification of product supporting stable retail demand, heightened demand for quick food service options and a favourable rainfall outlook have so far provided support to domestic cattle prices.

Market pressures

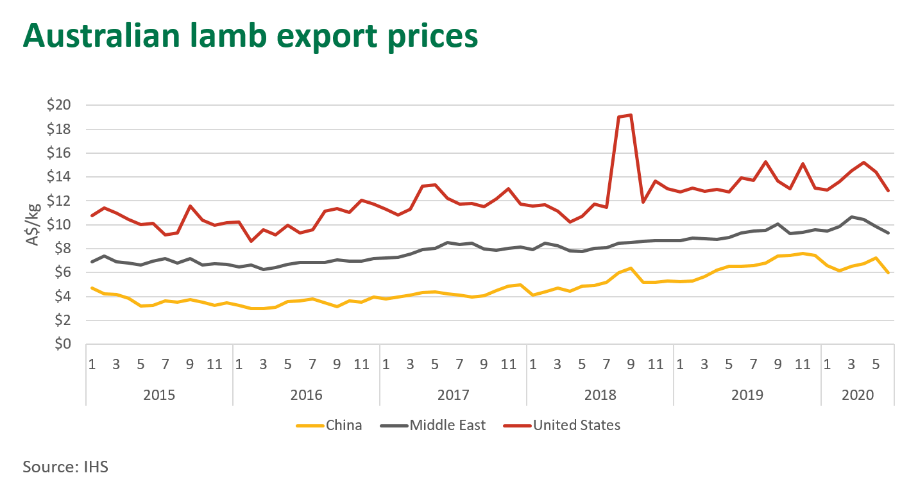

The three largest export regions for Australian sheepmeat in 2019 were the United States (US), China and the Middle East (MENA), accounting for 69% of total exports. A comparison with Australian beef exports shows that shipments to the US, China and Japan, accounted for the same percentage of total exports last year. However, Australia’s position within the global trading environment and differing exposure to retail and foodservice channels has contributed to the divergence in prices, as a myriad of COVID-19 impacts across the supply chain have had an overburdening effect on domestic sheep and lamb prices.

Australia produces a small portion of the world’s sheepmeat supply but accounts for approximately 38% of exports and is the largest supplier to the global market. Conversely, Australia accounts for around 16% of the world’s beef trade.

A full-scale return to pre-COVID-19 foodservice demand is unlikely in the short-term for high-end foodservice outlets. These outlets are usually a key channel for Australian sheepmeat due to its status as the leading supplier of prime lamb into global markets. Subsequently, the flow of Australian sheepmeat into key markets has fluctuated slightly relative to previous years.

Australian sheepmeat exports for the calendar-year-July

Lamb exports to China have performed well through 2020, lifting 1% for the year-to-July, to remain the largest export destination. Relative to total Australian lamb exports, China's market share for the year-to-date has expanded out to 27%, up from 24% in 2019.

The US has taken a hit and its reliance on the foodservice sector has underpinned a 3% decline in lamb shipments, albeit mutton exports have performed well. US cold stores report that lamb inventories in freezers are up 16% compared to year-ago levels, as end-users struggle to find suitable buyers.

Weakened demand from the Middle East has been multifaceted, as the crude oil-dependent countries battle with sharp economic pressures on the back of subdued oil prices, a downturn in the aviation industry and subsequent declines in tourism to the region. In contrast to the expansion seen in the China market, MENA’s total market share of Australian lamb exports has fallen 5% on 2019 to now sit at 20%.

Unsurprisingly, with Australia’s reliance of global markets, export prices have come under pressure, in turn pulling domestic offerings lower. The Middle East is regarded as a high-value market for Australian sheepmeat, with an established carcase trade to the region underpinned by substantial growth in air-freight in the last ten years.

Higher-value product that would normally be destined for the Middle East has seen a swing towards China, likely at a lower price point. While demand in China across all proteins remains robust as the African Swine Fever-induced deficits still remain, a continued preference for pork, forecast growth in the China flock this year and strong beef imports from South American suppliers (total China beef imports are currently up 43% on 2019 for the calendar year-to-date), has dampened average sheepmeat export prices.

While lamb is a popular protein across the Middle East and Asia, as a result of COVID-19, consumer disposable income could tighten, further supporting softening demand for lamb.

Retail support

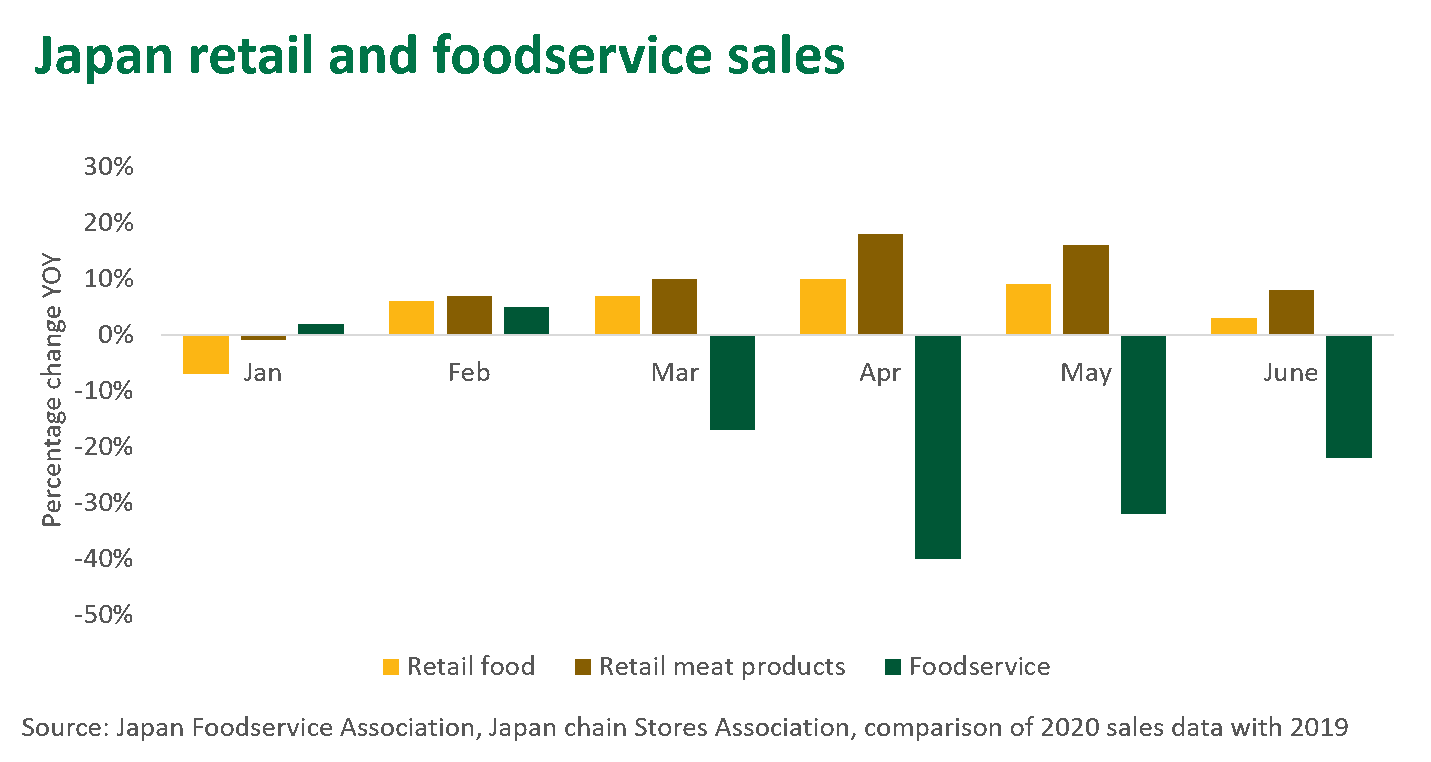

Amid the COVID-19 pandemic, demand for beef has remained buoyant, in particular at a retail level, as consumers have increasingly pivoted towards home dining. This has been evident in Australia and in key overseas markets where restrictions and lockdowns have been implemented. In established export markets such as Japan and Korea, Australian beef has a strong retail presence, which has helped to maintain a stable level of demand. This has been coupled with the fact that sheepmeat remains a niche protein across the world and beef continues to be the preferred protein in many of Australia’s key export markets.

Retail meat sales in Japan have softened since April with a gradual recovery in the foodservice sector, however, meat sales are outperforming overall food sales. In the US, Steiner Consulting Group commented that retail remains in good shape in the build up to the Labor Day weekend in September and demand for manufacturing beef is strong.

Domestic market influences

The developing situation in Victoria, the largest lamb processing state, has contributed to the market volatility in recent weeks. Processor workforce capacity in Victoria has been scaled back for six weeks, creating logistical challenges across the supply chain. However, lamb prices had started to recede before any state-wide restrictions came into place. The global uncertainty had spread into domestic markets and has specifically impacted processor and producer confidence, despite domestic conditions improving.

The availability of lambs for slaughter in the domestic market should only increase from this point onwards, as the number of new season lambs should gradually climb until October/November. On the back of improved seasonal conditions, reported survival rates are higher compared to year-ago levels, which will lend support from a flock rebuild perspective. However, the influx of new season lambs is showing at a time of sustained global demand uncertainty, and domestic prices have started to reflect the seasonal decline much earlier than the previous two years.

Prices

According to National Livestock Reporting Service (NLRS) data, young lambs to processors are up substantially across New South Wales, Victoria and South Australia to 91,000 head since 1 July, compared to year-ago levels when fewer new season lambs had entered the market. These trends highlight a challenging situation for producers, as supply is exceeding demand, furthering the impact on saleyard and grid prices.

Across the cattle market, yardings have continued to decline this week, fuelled by good rainfall across the eastern states, and with no sharp increase in supplies anticipated, prices should continue to find support. That being said, cattle prices are not immune to the COVID-19 headwinds. Processors are increasingly stretched in securing finished cattle. Recently, a large export processor has scheduled a two week plant shutdown due to a lack of cattle supply, drawing to attention the opposing supply dynamic in the cattle market.

The National Trade Lamb Indicator on Tuesday 11 August was reported at 696¢/kg carcase weight (cwt), down 159¢/kg compared to last year. However, the indicator remains 63¢ above the five-year average, despite a sharp decline since 1 June.

The National Heavy Lamb Indicator on Tuesday 11 August was reported at 631¢/kg carcase weight cwt, down 254¢/kg compared to last year. The indicator has now moved in line with the five-year average at 637¢/kg cwt. Heavy export lambs have seen the largest decline of all categories as processors have to increasingly sort lighter specifications.

The National Feeder Steer Indicator was reported at 390.9¢/kg live weight (lwt) on Tuesday 11 August, 87¢ above year-ago levels and 77¢ higher than the five-year average. Strong competition for suitable feeder cattle and heightened demand for restocker cattle, combined with a limited availability of steers in the domestic market, has helped sustain high prices.

The National Medium Cow Indicator on Tuesday 11 August was reported at 272¢/kg lwt, 58¢ higher year-on-year and 59¢ above the five-year average. Demand for breeding stock has lifted on the back of improved conditions and solid demand for grinding beef in domestic and global markets has seen processors competing more fiercely with restockers this year.

The Eastern Young Cattle Indicator (EYCI) was reported at 758.25¢/kg cwt on Tuesday 11 August, 226¢ higher year-on-year and 193¢ above the five-year average. On the back of more good rainfall across the eastern states, a decline in store cattle yardings and the intention to restock paddocks, these factors continue to keep the indicator within touching distance of its record level.

© Meat & Livestock Australia Limited, 2020