Growing export prices push the value of Australian red meat exports up in Q1

Key points

- Total value of red meat exports for Q1 2020 is up 20% on 2019.

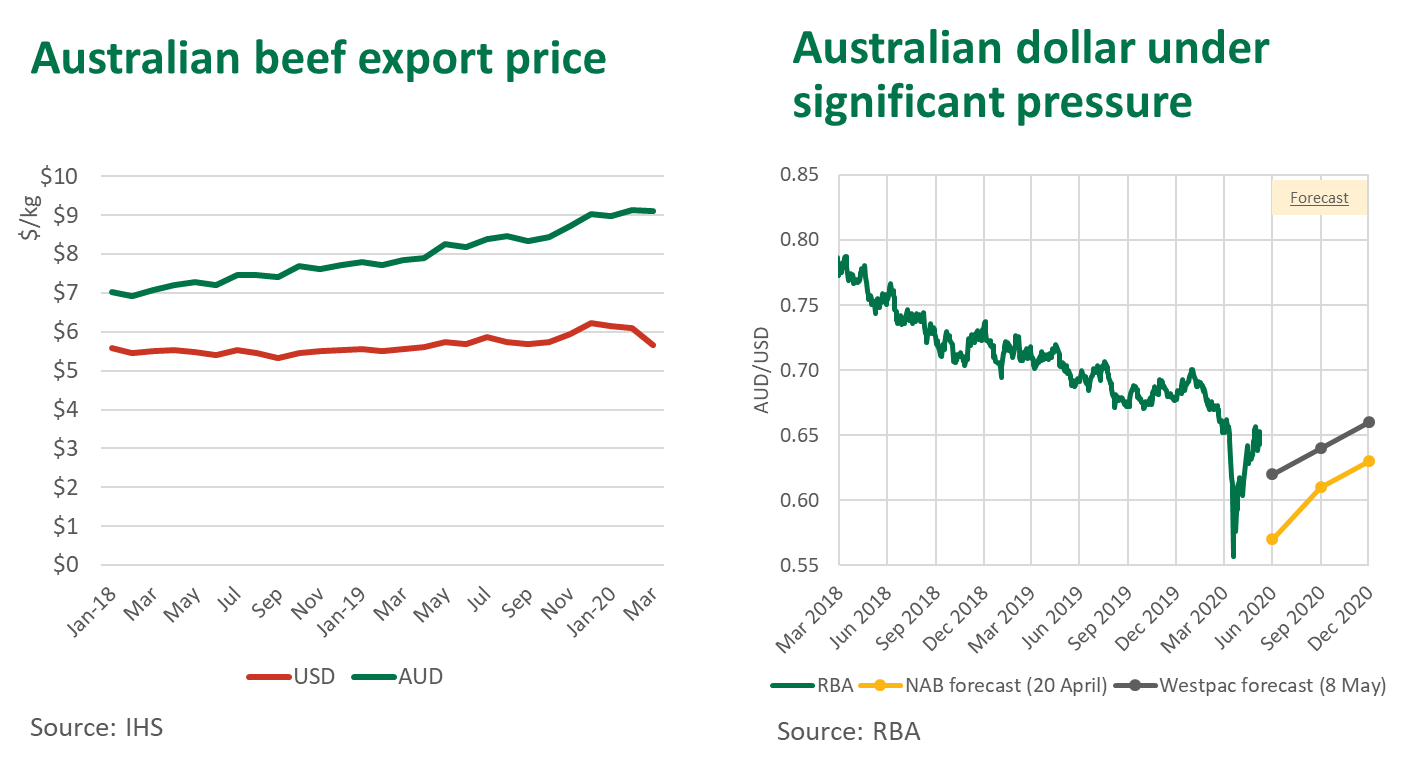

- High domestic livestock prices, a softer A$ and strong buying competition drove price growth across all categories.

- Average Australian beef export price up 16% in Q1 year-on-year.

While global trade is struggling at the hand of COVID-19, the value of Australian red meat exports in the first quarter this year grew 20% year-on-year to A$3.7 billion. It is important to note that the COVID-19 global disruption outside of China really only intensified in March, which means some of recent trade shifts aren’t reflected in these numbers.

The value of beef exports for the first quarter was A$2.57 billion, up 22% on the same period in 2019. The quantity of beef exported in the first quarter was only slightly up, meaning that the 22% increase in value was attributed mostly to the lift in export prices. Significant rainfall events in February and March triggered a surge in restocker demand and a tightening of slaughter livestock supplies, pushing key cattle indicators to record levels. These supply side forces, combined with favourable shifts in exchange rates, competing international demand and increasingly positive consumer perceptions of Australian beef, all pressured export prices higher in Q1.

While demand from China eased after the Lunar New Year and the impact of COVID-19 began to show, the value of first quarter beef exports to the market increased 30% on the same period last year, to A$560 million. Strong demand was also evident in a number of other key markets early in the year, such as Japan and Indonesia, which also helped to foster this growth.

A similar trend is evident for sheepmeat. Exports of sheepmeat were back 2% on 2019 in terms of volume but were up 17% in terms of value, totalling A$1.13 billion for the quarter. While lamb experienced an 11% lift in export prices, mutton prices grew by 31%, supported by surging restocker demand driving livestock prices, along with the appetite of the Asian and US market driving price competition. With lamb and sheep supplies expected to drop in the coming months, this should continue to lend support to prices.

Currency rate supporting to export value

After showing some signs of recovery late last year, the A$ has fallen below 70 US¢ since January, now residing at 65 US¢ as of May 12. The outbreak of COVID-19 in March undoubtedly caused untold strain on markets, which saw the A$ fall as low as 58 US¢ in late March. The A$ is also back against the currencies of most of Australia’s major red meat markets. This downward pressure on the exchange rate has heightened price support for exports and the A$ is forecast to remain subdued through the rest of the year. However, with the US the exception, Australia’s red meat export competitors’ currencies have also depreciated, especially Argentina and Brazil.

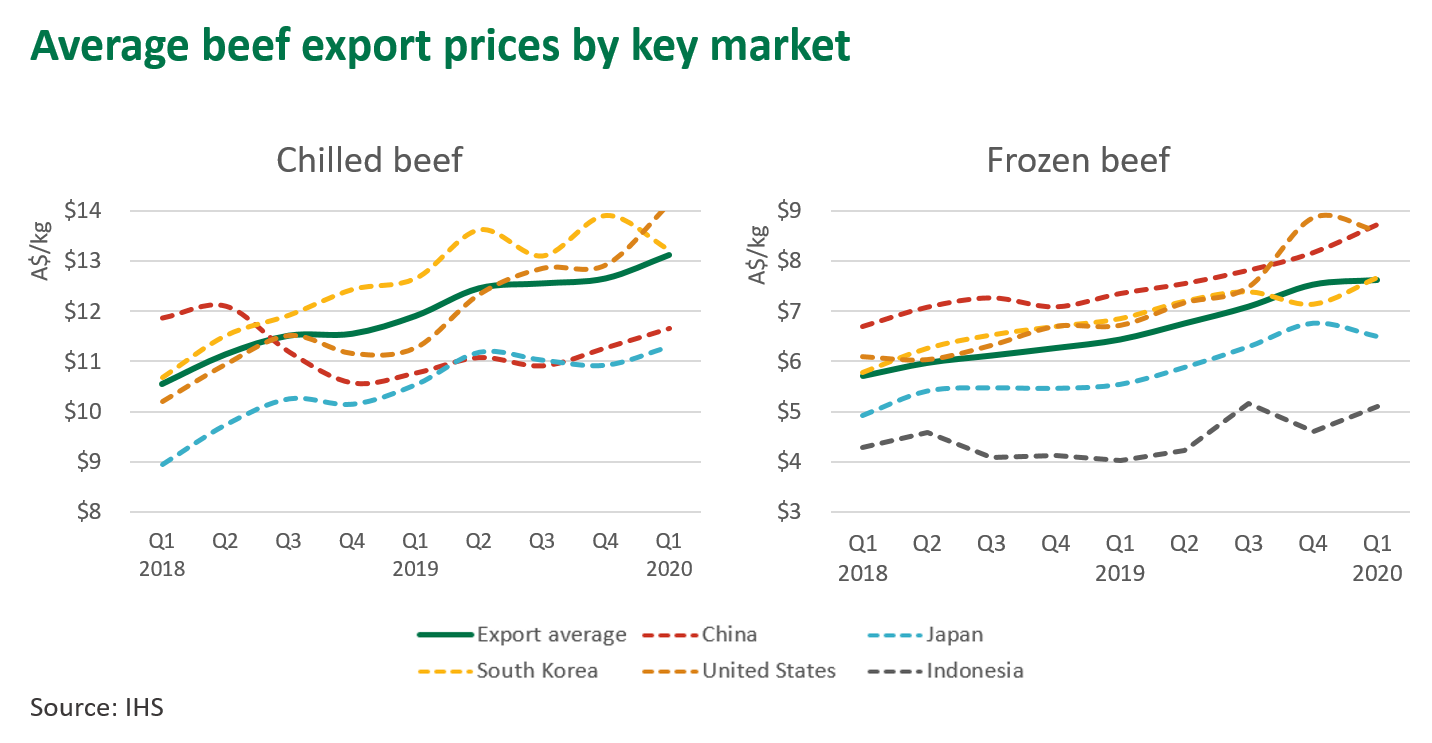

Export prices of both frozen and chilled beef lift

Frozen beef prices have rallied, up 19% on this time last year, averaging A$7.63/kg for Q1 2020, while the price of chilled beef has also lifted significantly, now up 10% on last year, averaging A$13.30/kg for Q1 2020.

Two of Australia’s primary markets for frozen beef, China and the US, continued to drive export prices with competitive bidding behaviour, with prices up 19% and 28% for both markets respectively in Q1. China has become a key market for frozen forequarter and hindquarter cuts, while the US remains to be the primary market for manufacturing beef. Indonesia, Australia’s fifth largest beef market, also had encouraging growth, with the price of frozen beef up by 27% on 2019.

Looking ahead, the outlook continues to be clouded by the volatility and uncertainty surrounding the impact of COVID-19. Prices should find support from tight domestic supply, Australia’s premium position within many markets, ASF fuelled demand from Asia and a supportive exchange rate.

Additionally, the impact of COVID-19 continues to affect processing plants across Australia’s competitors in the short-term, particularly in the US where production capacity has declined significantly in recent weeks. However, a global recession looms and with over two thirds of Australian exports destined for the heavily impacted foodservice channel, how this sector recovers and performs as markets overcome and ease back COVID-19 restrictions will continue to be critical.

© Meat & Livestock Australia Limited, 2020