Lamb prices march on

Key points

- Restocker activity surges as producers look to rebuild or add weight

- Historically, lamb supply tightens over the coming months

- Domestic lamb prices supported by lower Australian dollar.

With March underway and the majority of lamb categories at or nearing record prices, what does the short-term hold in store for supply and subsequent prices?

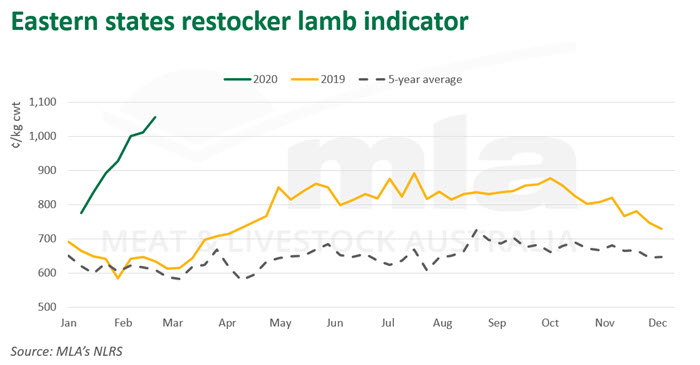

The eastern states restocker lamb indicator was reported at 1,067¢/kg carcase weight (cwt) on Tuesday 3 March, 4¢ below the record set on Monday, yet 439¢ above year-ago levels. Heavy lambs were recorded at 948¢/kg cwt, up 313¢ year-on-year.

Significant rainfall across key sheep producing regions has seen restocker activity surge as producers look to rebuild their flocks. Increased competition between restockers and processors, combined with lower sheep yardings and the prospect of limited availability in the months ahead has resulted in elevated saleyard prices. Despite record domestic prices, export markets are yet to be discouraged given the support provided from a depreciating Australian dollar in recent months.

Looking to supply trends over the past five years, lamb availability from now through until spring has typically been buoyed by the supply of old season lambs or by producers in the south who have adapted their production system. NSW has historically propped up winter lamb supply, accounting for 70% of lamb yardings through the winter months followed by Victoria at 25% and SA at 5%.

The trend has been somewhat distorted in the last two years, due to consecutive years of drought prevailing across the east coast. A combination of fewer lambs and difficulty in finishing lambs drove prices to record levels through winter in 2018 and 2019. Heavy lambs climbed to a new record of 1,000¢/kg cwt in July last year. The fact that the majority of indicators achieved or approached record levels through the summer could suggest further upside, in particular with export demand holding. Lamb prices will be expected to remain at historically high levels, given the supply pressures. However, at these elevated levels, producers with feed will hold onto stock to add more weight, this could potentially help bolster winter supplies and offer some resistance to current prices.

© Meat & Livestock Australia Limited, 2020