What's in store for live exports in 2021?

Key points

- Demand for live cattle in South-East Asia is forecast to rebound upwards this year

- Low livestock supply and high prices remain key challenges for the export industry

- Market conditions for sheep trade in the Middle East remain challenging, yet consumer demand remains.

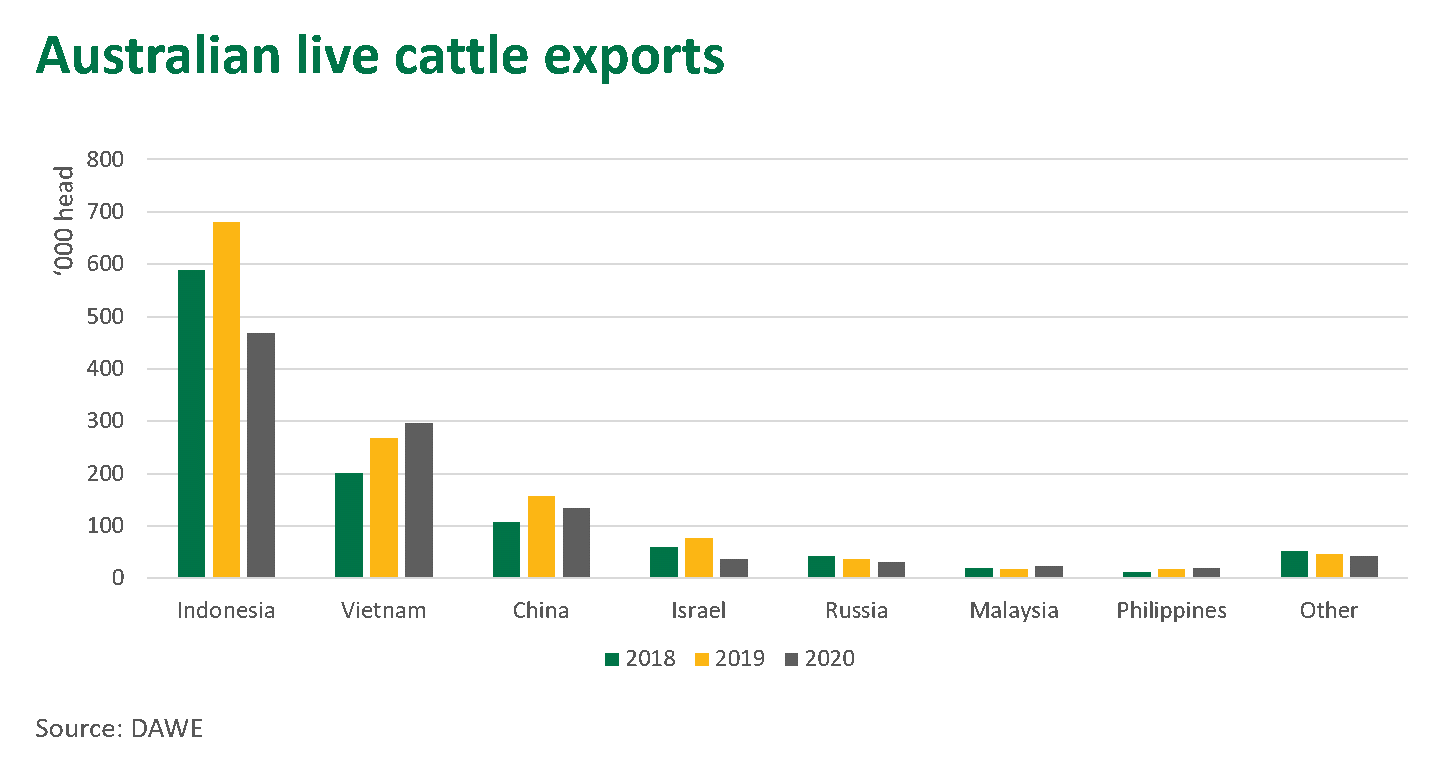

Live cattle exports

Australian live cattle exports faced many challenges in 2020, with high cattle prices, a rising Australian dollar during the second half of the year and weakened consumer purchasing power in Indonesia. Consequently, total live cattle exports fell 19% year-on-year to reach 1.06 million cattle, with a 26% fall in feeder exports, a 17% fall in breeder exports and a slight rise in exports of slaughter cattle, driven primarily by Malaysia.

Encouragingly, demand for live cattle from Australia’s key market, South-East Asia, is expected to see some recovery during the second half of 2021. GIRA has forecast imports of live cattle to lift by 10% this year, largely off the back of a likely rebound in consumer confidence following COVID-19 vaccine roll-outs.

MENA cattle imports are forecast to lift by 4%, with increases expected for all countries except Turkey and Saudi Arabia (GIRA). However, competitive presence across these markets is likely to continue building.

Regardless, challenges for the Australian live export trade remain. With the national herd at a 25-year low, this is expected to constrain the availability of livestock for export for some time. MLA’s Cattle Industry Projections, released in February, forecast live cattle exports to contract 9% to reach 962,000 head this year.

Indian Buffalo Meat will continue to be a key competitor for Australian live cattle, particularly in South-East Asia. Current forecasts indicate India will increase boxed exports by approximately 20% year-on-year in 2021 (GIRA), after a fall in exports during 2020 due to COVID-19 lockdowns.

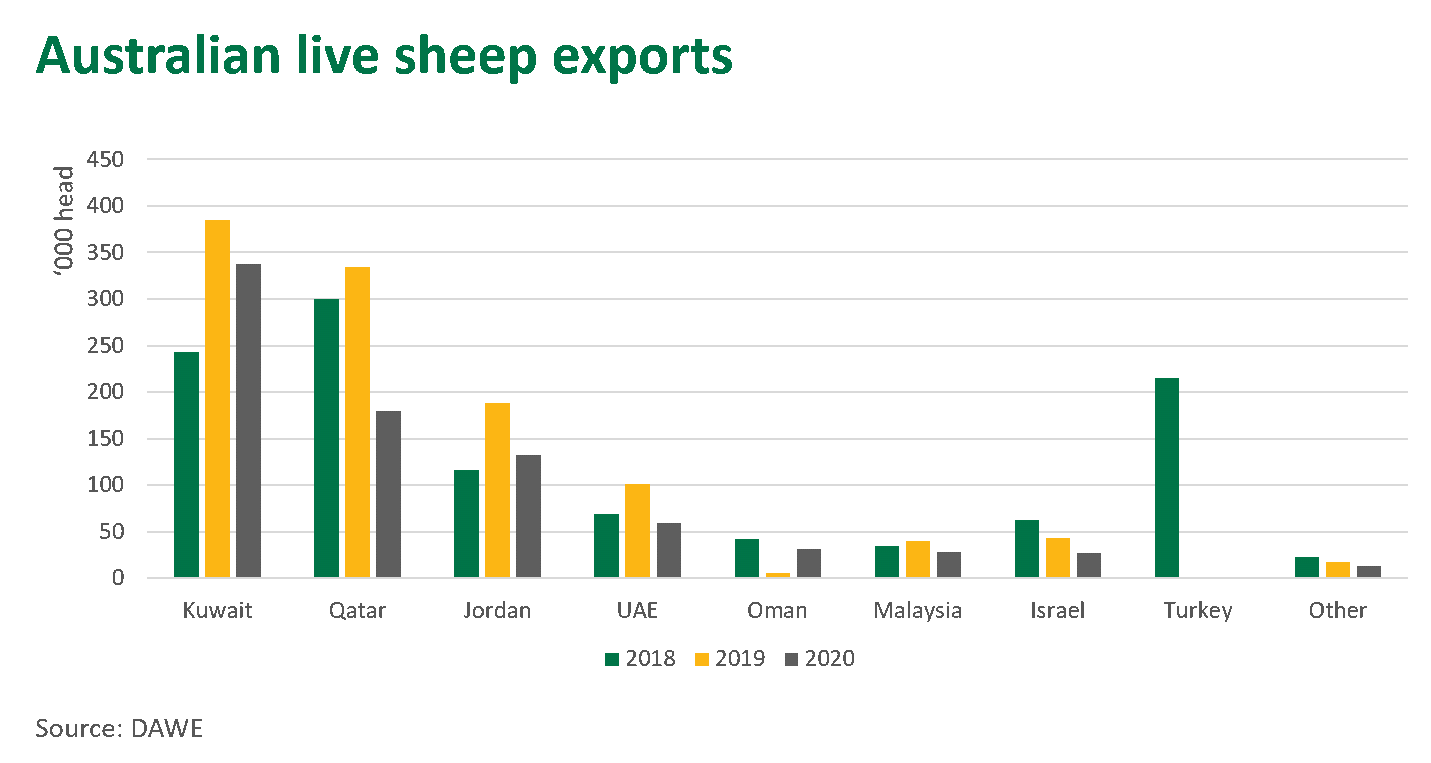

Live sheep exports

Live sheep continue to be an important export for Australia. However, in 2020 export volumes reached a historic low, in part reflecting the gradual, long-term decline in the national sheep flock. In 2020, sheep exports reached 812,000 head, a 27% decline on 2019 levels. While there were numerous challenges associated with COVID-19, high Australian sheep and lamb prices and a higher Australian dollar during the second half of the year also weighed on global demand for sheep.

Import demand for sheep in the Middle East region was notably lower in 2020 relative to previous years. The drop was driven largely by various COVID-19 impacts, including lower oil prices, lower consumer confidence and incomes, reduced tourism and social gatherings.

Fortunately, overall consumer demand for live sheep in the Middle East is expected to see some recovery, with volumes consumed expected to lift around 4% in 2021 on 2020 levels (GIRA). Live sheep imports will continue to be a key source of fresh sheepmeat in many Middle East markets due to consumer preference, with demand increasing to meet growing populations and incomes.

However, while in-market consumer demand in MENA may be trending upwards, this is unlikely to align with live sheep exported from Australia in 2021. This is due to a combination of changing market conditions including supply constraints, changed import arrangements in Australia’s second largest live sheep market of Qatar and reducing demand for both live sheep and chilled carcases. Importers will supplement Australian live sheep supply with sheep from other countries to meet demand.

For more information, please refer to the recent update of the Live Link report.

© Meat & Livestock Australia Limited, 2021