Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Feeder market outpacing finished cattle

23 August 2016

While feedlots have enjoyed ample numbers of cattle in recent years (click here for the latest quarterly lot feeding brief), the current and forecast supply of cattle – and the impact this is having on feeder prices – will continue to be a challenge going forward. Cattle prices across the eastern states have continued to rally since May, on the back of good rainfall, a favourable seasonal outlook and reinvigorated restocker demand.

Eastern states feeder paddock prices, collected by MLA this week, were mostly steady on the week prior, but remain well above year-ago levels.

- The domestic paddock feeder steer indicator was steady, at 375¢/kg lwt

- The domestic paddock feeder heifer indicator lifted 3¢, to average 360¢/kg lwt

- The short-fed Angus feeder steer indicator was steady, averaging 380¢, but with some quotes as high as 410¢/kg lwt

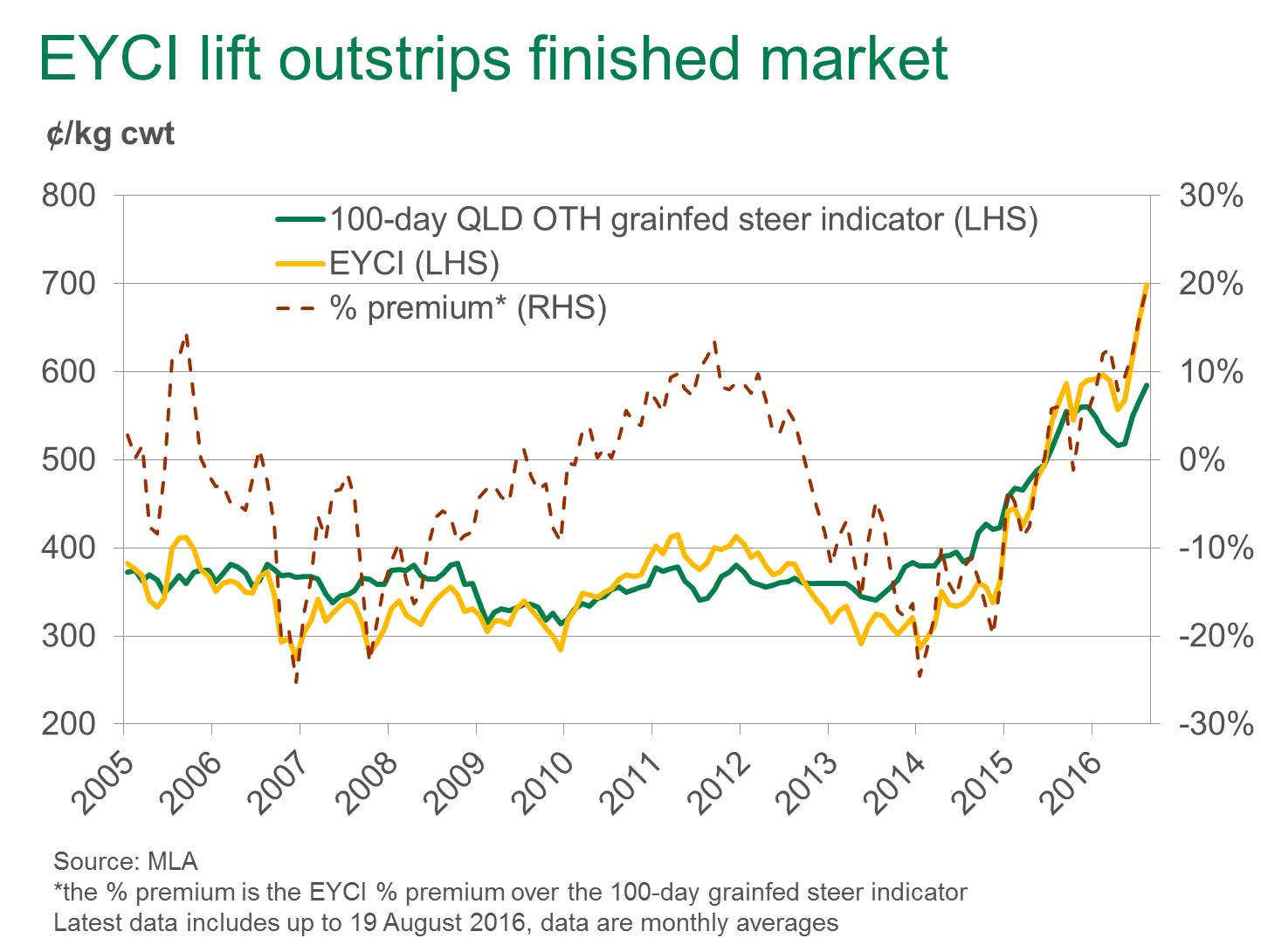

At the other end, grain-finished cattle prices have increased in recent months but have been unable to keep pace with the surging feeder cattle market. In fact, as illustrated in the figure below, the current premium of the Eastern Young Cattle Indicator (EYCI) over the Queensland over-the-hook (OTH) 100-day grainfed steer indicator is the highest it has been over the past ten years. It should also be noted the chart below (latest data includes to the 19th of August) does not reflect the 15-30¢/kg cwt decline in the Queensland OTH indicators this week. At the close of Monday’s markets, the EYCI was trading at a 25% premium to this week’s Queensland 100-day OTH grainfed steer indicator.

However, the basis between the EYCI and grain-finished OTH indicator may not be the best indicator of feedlot margins as restockers, particularly from Queensland, are increasingly accounting for a larger share of the indicator and paying a premium over feedlot and processor buyers for EYCI eligible cattle.

Some relief for feedlots, however, may come from the possibility that spring will bring greater numbers of feeder cattle onto the market – albeit off an already low base. Looking over the past ten years, the EYCI has typically eased 4% between the start and finish of spring; the largest fall was 23% in 2006, while the biggest increase was 5% in 2010.