Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

EYCI loses it's spring

19 September 2017

The start of spring has seen the Eastern Young Cattle Indicator* (EYCI) continue its downward trajectory to a level that hasn’t been recorded for almost two years. This is a contrast to the indicator’s upward trend during spring in 2015 and 2016, the result of low US beef production, a strong global beef market and fierce restocker demand.

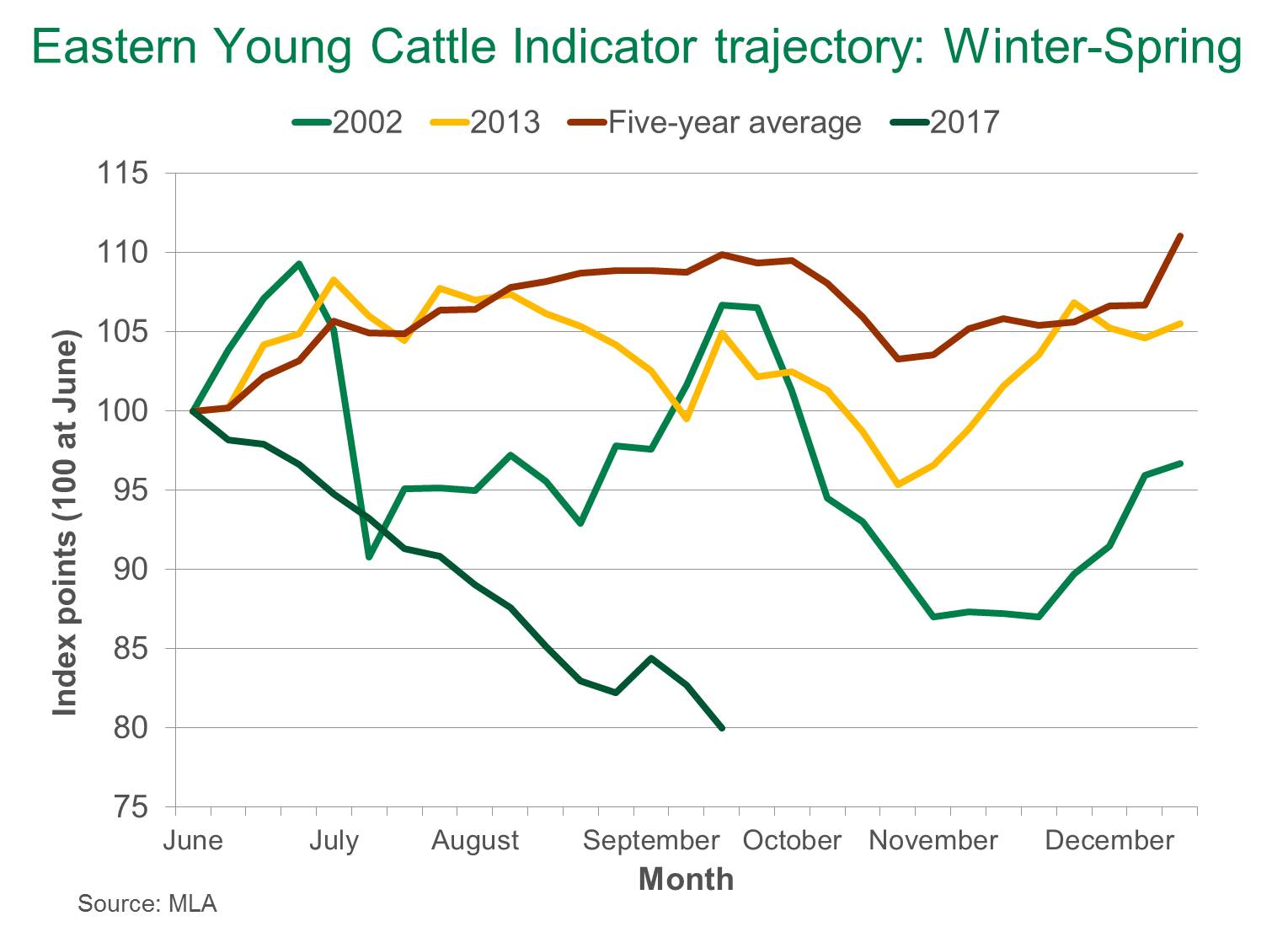

The EYCI opened the 2017 spring season at 551.50¢/kg cwt and settled on 521.25¢/kg cwt by 18 September, down 24.25¢/kg cwt. The figure below – the EYCI indexed from the beginning of winter through to December – illustrates the unseasonally high downward pressure exerted on the indicator since June.

As depicted in the graph by the five-year average, recent years have seen the EYCI exhibit stable or positive growth during the winter months, while some seasonal price discounts take effect during spring when supplies typically increase. The EYCI did not find the support during winter this year, however, and is charting new territory – even compared to the years of 2013 and 2002. Aside from the seasonal similarities of the three years, 2013 and 2002 also represent the years where the EYCI declined significantly over the calendar year.

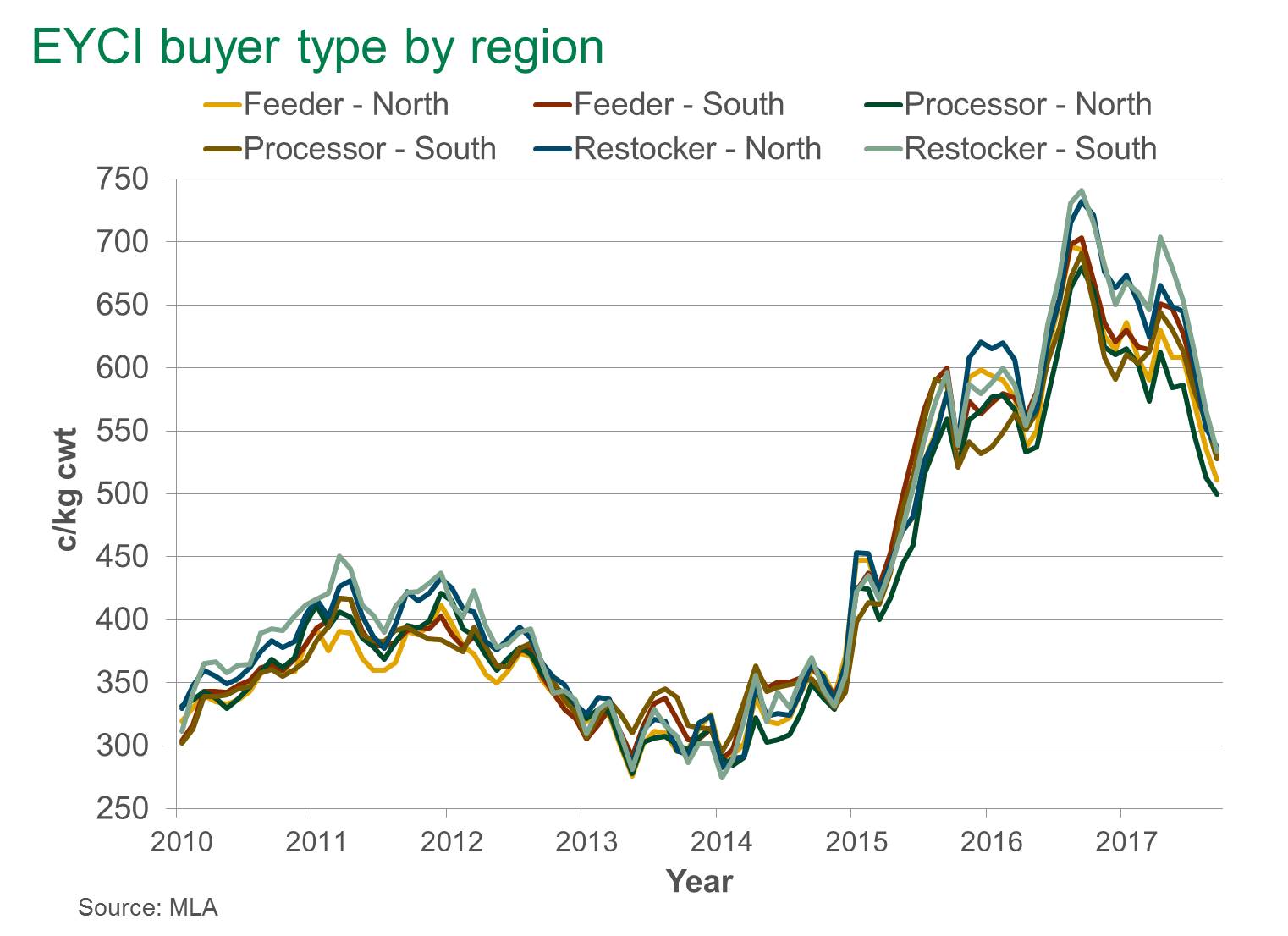

There are a number of factors underpinning the correction in today’s cattle market. Ongoing poor seasonal conditions have driven increased turn-off and impacted buyer dynamic. Deteriorating pasture conditions have dampened restocker demand. The premium typically paid by restockers, over feeder and processor purchases, has narrowed. In the first two weeks of September, average prices paid for EYCI eligible cattle by the three buying groups differed by a range of 37¢/kg cwt. This time last year the difference equated to around 60¢/kg cwt.

Restockers are still paying a premium this September, with northern restockers keeping pace with that of their southern counterparts, along with southern feeder buyers and processors. Meanwhile, northern processors and feeder buyers are purchasing at the greatest discount.

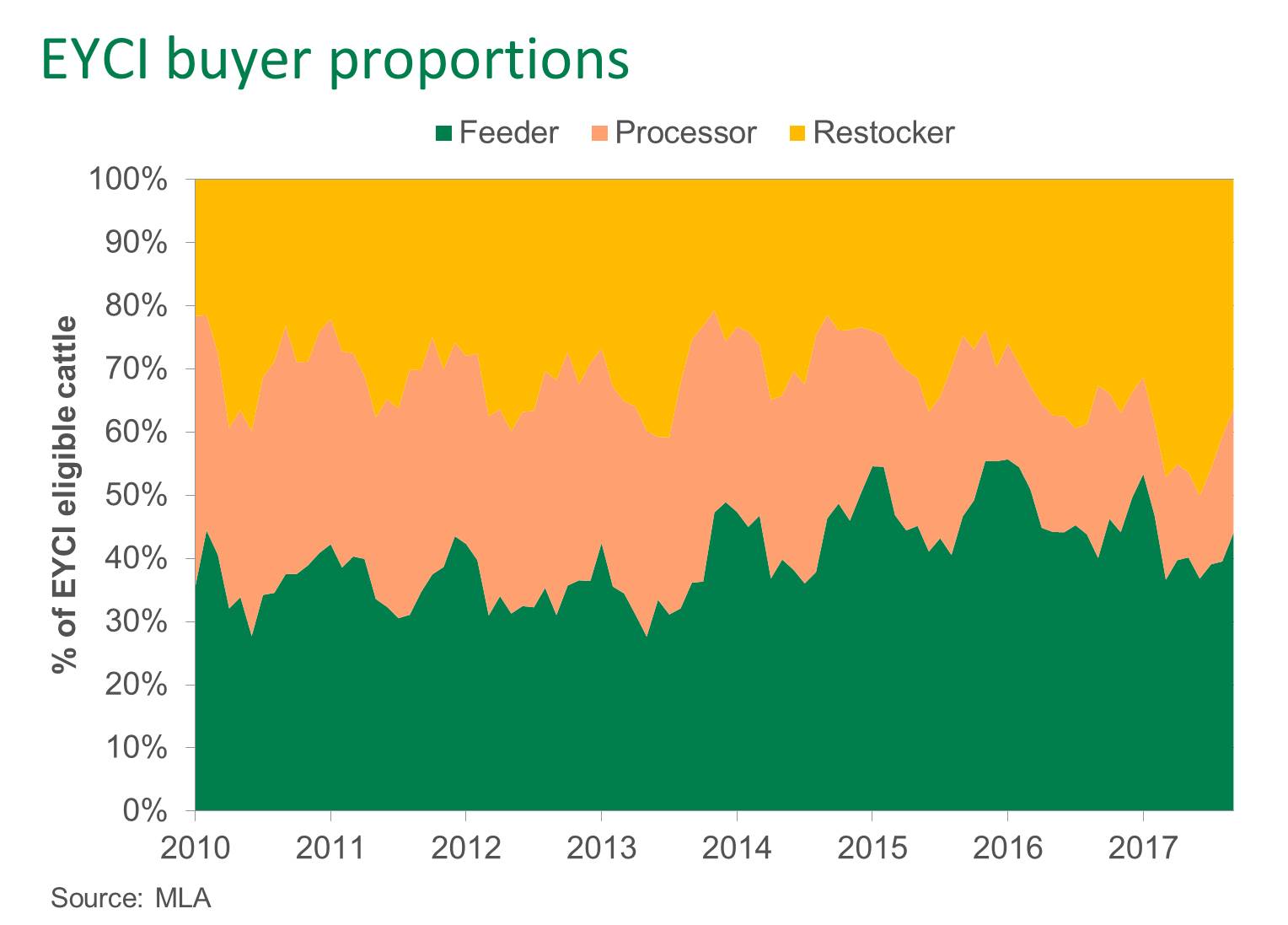

In line with seasonal trends, the proportion of EYCI eligible cattle sold to restockers during September-to-date lifted on year-ago levels, reaching 36%, but declined from recent months. This was aided by a decrease in competition from lot feeding on the back of recovering grain prices. However, as for the physical number that restockers are procuring through the saleyard system, August represented a 34% decline from year ago levels.

Processors, who historically account for approximately a third of EYCI eligible cattle sales have seen an ongoing decline throughout 2016 and into 2017 in the proportion they purchase – accounting for 20% for September thus far.

Looking ahead, a recent seasonal break for parts of Victoria and a fairer three-month rainfall outlook by the Bureau of Meteorology may boost restocker demand and provide some support to the market in the short term. Meanwhile, any widespread seasonal break in the north would likely have a longer lasting effect on demand due to the hampered rebuilding efforts and lower base from which these production systems are coming from.

* EYCI eligible cattle are C2 & C3 yearling and vealer cattle over 200kg sold through MLA reported saleyards in the Eastern States (Qld, Vic and NSW)