Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Limiting trading in the US imported beef market

13 November 2017

US imported beef prices stabilised this week as a result of reduced trading in the market, caused by a decline in fed cattle prices. Firm asking prices from overseas suppliers and tight availability for spot supplies will continue to support prices in the short term.

The imported 90CL beef indicator edged 0.5US¢ higher from week-ago levels, to 209US¢/lb CIF (up 2A¢, to 600.85A¢/kg CIF).

Beef demand has exceeded expectations so far this calendar year and the outlook remains robust heading into 2018. US beef production is forecast to expand next year, supported by a larger cow herd, improving pasture conditions and ample feed supplies.

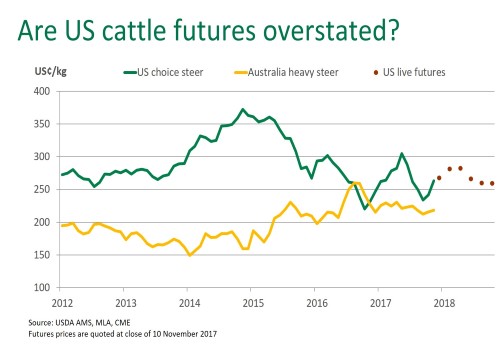

US fed cattle futures declined 5% during the week, following a move lower in paid cash prices. Live cattle futures (April 2018 contract) are currently priced at a premium to the spot market (10 November 2017). This often occurs ahead of the summer months as the market prices reflect the peak-demand over grilling season. However, futures contracts for the second half of 2018 are closer to current market levels.

Highlights from the week ending 11th November:

- Beef imports from grinding beef supplying countries totalled 8,160 tonnes, 21% higher than last year

- Seasonally, US retail ground beef demand declines in Q4 but then improves in the new year as retailers empty the meat case of holiday items

- Fed cattle slaughter for the week was estimated at 499,000 head, down 3.5% from a week ago but still 2.5% higher than the same week last year

Click here to view Steiner Consulting US imported beef market weekly update