Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

EYCI finds support in June

27 June 2018

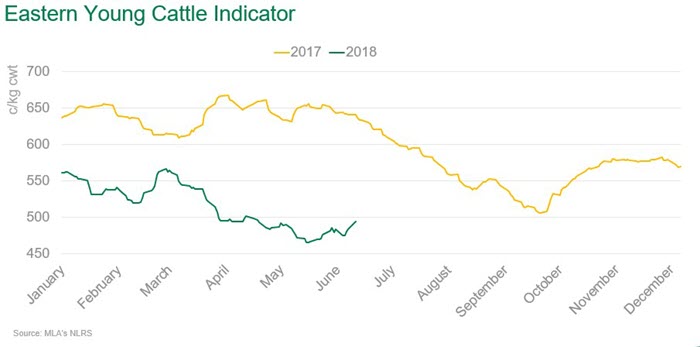

The Eastern Young Cattle Indicator (EYCI) has shown signs of stabilising following a steady decline since mid-March. On Tuesday 26 June, the EYCI was 494.75¢/kg carcase weight (cwt), a climb of 29¢/kg since the beginning of June, representing the most growth in three months.

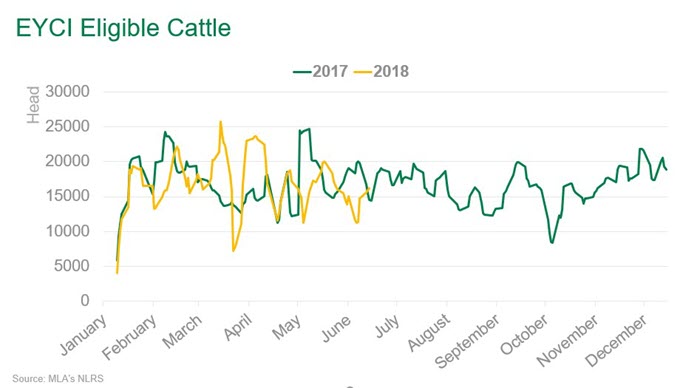

Although the indicator remains 142.5¢, or 29%, below this time last year, it is 15.5¢ higher than the five-year June average. This rise comes as the supply of young cattle starts to tighten and some useful rain falling in parts of the south-east - with the June average daily yarding for EYCI eligible cattle in 2018 14,598 head, down 18% from the same period in 2017 and 14% lower than the daily consignments in May.

Most of the EYCI eligible cattle sold to feeder and restocker buyers last week, accounting for 45% and 39% respectively, although there was a small rise in young cattle going to processors over the past week, from 13% to 16%. While not taking the largest percentage, processors are paying a premium for their cattle, underpinning the lift in consignments, paying on average 4¢/kg more than feeder buyers and 55¢/kg more than restockers.

On Tuesday, nearly all sales recorded an increase in price for EYCI eligible cattle:

- Scone was up 83¢ on last week, to be the biggest improver, averaging 497.57¢/kg cwt

- Gunnedah lifted 50¢, to 503.65¢/kg cwt

- Roma store sale increased 22.27¢ to 487.21c¢/kg cwt

- CTLX Carcoar was up 12¢ to 559.12¢/kg cwt

- NVLX Barnawatha up 23.58¢ to 522.72¢/kg cwt

Rain across parts of Victoria and southern NSW over the last week has helped to give the market a boost, and more rain, albeit not substantial amounts, is forecast for a large portion of the eastern seaboard over the coming week.

While the Bureau of Meteorology’s most recent three month rainfall outlook is not a positive one for eastern Australia, the prospect of rain looks to have encouraged some producers to hold stock back from sale, rather than offloading at the high rates seen in May and April, especially with the EYCI currently improving.

Although the EYCI has started to recover in June, whether this continues will depend largely on the extent of follow-up rain. The price rallies seen in October 2017 and again in March this year, following widespread rain demonstrates the market’s ability to respond quickly should the season improve.