Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

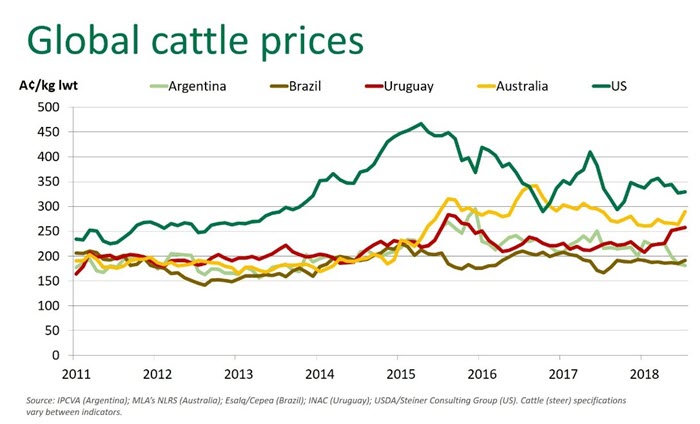

How are Aussie cattle prices performing globally?

01 August 2018

Competition for quality slaughter cattle in Australia – at a time of sustained dry conditions and robust global demand for beef – has supported finished cattle prices in recent months. Meanwhile the finished cattle market (in A$) in the US and Argentina has eased, Brazil has flat lined and Uruguay has recorded a modest break away from the rest of South America.

Australia

The national heavy steer saleyard indicator finished Monday at 287¢/kg live weight (lwt), up 6¢/kg on last year – the only daily cattle indicator to display a year-over-year increase. Despite increased cattle turn-off in recent months, processors grids have lifted in line with sustained demand for high quality product from export markets.

The cattle over-the-hook indicators trended higher throughout July, supported by the aforementioned factors but have since stabilised as a lack of rainfall continues to push cattle forward. Nationally, all indicators have shown a positive trend and the Queensland heavy steer over-the-hook indicator (300–400kg, A-C muscle) averaged 491¢/kg this week – up 21¢/kg carcase weight (cwt) from the beginning of July.

The latest Bureau of Meteorology (BOM) three-month rainfall outlook points to drier than average seasonal conditions across much of the country. As highlighted in the latest MLA cattle projections, poor seasonal conditions and lack of pasture will continue to underpin elevated slaughter throughout the rest of 2018, however quality finished cattle may remain in short supply.

Argentina & Uruguay

In competitor markets, currency fluctuations – as is often the case when comparing prices on a currency-adjusted basis – have contributed to a lift in the price of cattle Uruguay and a decline in Argentina.

The Argentinian peso has been in free fall recently as the economy struggles with the removal of subsidies, high inflation and one of the worst droughts in decades. The latest gross domestic product figures indicate the economy contracted 5.8% in May, with the agriculture sector declining 35% compared with the same period the year prior. Accelerating levels of inflation are a major cause for concern and the possibility of the country entering recession this year has risen.

Conversely, the Uruguayan economy has been buoyant through the first half of 2018, driven by solid domestic demand and sustained consumption growth. However, the economy remains exposed to external shocks, in particular the neighboring economic turmoil in Argentina. Northern parts of the country are also suffering from similar drought conditions.

Brazil

Brazilian cattle prices have remained largely unchanged on a currency-adjusted basis. The Brazilian Real, depreciating against the Australian dollar, has offset a modest lift in local cattle prices – an indication supplies may be beginning to tighten. Political upheaval has also weighed on cattle prices, as consumer confidence remains subdued.

The impact of the Brazilian trucker strike in May on cattle prices remains unclear; however, the broader impact across all agricultural commodities has been extensive and it has rattled the economy. Brazilian beef exports in June collapsed to their lowest level since January 2011, at 54,500 tonnes swt, as product struggled to reach ports.

US

US cattle prices have eased in recent months but have been somewhat resilient in the face of record beef production. Strong domestic demand has absorbed the additional supply that has not found its way into booming export markets.

US fed cattle futures – August and October contracts – are priced in line with the current cash market but longer horizon contracts have priced in a lift at the end of the year. The US choice fed cattle indicator averaged 244A¢/kg live weight (lwt) in July.

However, a number of curve balls are present in the US market. The impact of retaliatory pork tariffs from China and Mexico, at a time of peak US production, have the potential to push more product onto the domestic market, competing for retail space and pressuring US cattle and beef prices lower.

Furthermore, as discussed last week, continued dry conditions in key cattle producing regions could see a further lift in non-fed cattle slaughter, placing pressure on the US herd and cattle market. Given the weight US beef has on global markets, and export footprint it shares with Australia, any downward shift in the US cattle market will pressure Australian prices.