Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Producers facing difficult drought decisions

20 June 2018

Drought conditions present livestock producers with many and varied challenges, and the decision to hold or sell livestock is a difficult one.

As winter sets in, ongoing dry conditions are forcing many producers, who are in a position to do so, to reassess their position. Does the potential upside in prices justify the high cost of feeding?

In this article, we look back to previous drought events to look at how prices were impacted – both during the dry and when the drought broke.

Firstly, using historical events to predict future price trends is fraught with uncertainty. Prices are not solely influenced by the weather, and no two seasons are the same. While these limitations exist, an examination of drought periods of the last 20 years may shed some light on possible future price movements.

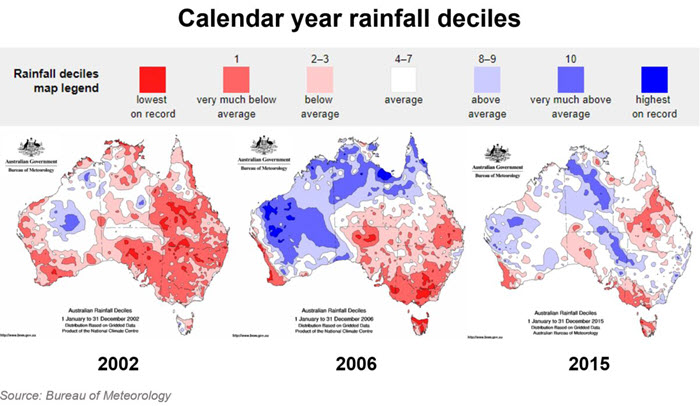

What was described as a “1-in-100 year drought” occurred in 2002-03 and then again in 2006-07, while 2012-16 saw an extraordinary run of failed seasons in Queensland. Figure 1 demonstrates just how dry these periods were, with certain areas recording the lowest rainfall on record.

Figure 1:

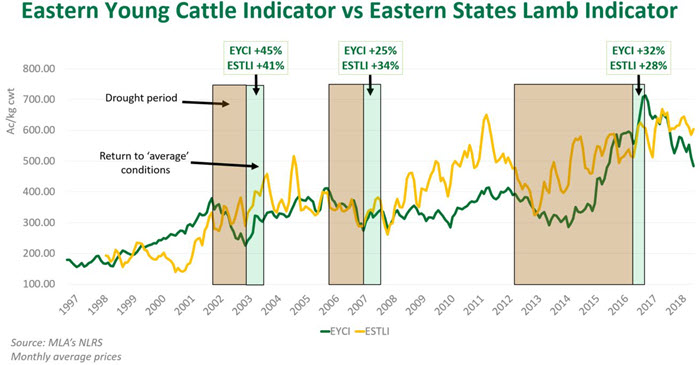

For the purpose of this article, and as shown in Figure 2 below, historical levels for the Eastern Young Cattle Indicator (EYCI) and the Eastern States Trade Lamb Indicator (ESTLI) have been examined. Three dates towards the end of these drought periods in 2002, 2006 and 2016 have been chosen, specifically when prices hit a low point. After which, a return to more ‘average’ conditions was experienced across many regions (but not all) in the following 6-month period.

Figure 2:

The first ‘price low point’ occurred on 7 November 2002. Following this, decent rainfall was received across the nation in February 2003. This period coincided with the discovery of bovine spongiform encephalopathy (BSE) in the US and Canada in late 2002, which reduced export competition for beef in global markets. The EYCI responded by rising 106¢/kg carcase weight (cwt), or 47%, reaching 331¢/kg cwt on 22 April 2003. In the same period, the ESTLI rose 122¢/kg cwt, or 43%, to reach 409¢/kg cwt.

Again, in 2006, drought conditions prevailed. Decent rainfall in the first three months of 2007 saw prices rebound strongly from December 2006 to June 2007. The EYCI rose 69¢/kg cwt, or 26%, reaching 334¢/kg cwt on 6 June 2007. The ESTLI rose 101¢/kg cwt, or 34%, to 394¢/kg cwt.

The table below details price movements for each indicator in the six months following the identified dates, and also the time it took (in months) for each of the respective indicators to return to the previous 12-month high.

|

Price low-point |

Price increase in the following six months |

Time taken to return to previous 12-month high (months) |

||

|

|

EYCI |

ESTLI |

EYCI |

ESTLI |

|

7 November 2002 |

47% |

43% |

20 |

4 |

|

6 December 2006 |

26% |

34% |

30 |

3 |

Source: MLA’s NLRS

The Australian lamb market has strong seasonal influences, such as the spring influx of lambs. Secondly, when pastures recover following a drought, lamb supply can generally respond faster than the supply of young cattle. These dynamics often translate into short-term lamb price volatility, demonstrated by the shorter time it took for prices to recover than for cattle.

To use a more recent example, price increases following widespread rain in June 2016 are detailed in the table below:

|

Price low-point |

Indicator level (¢/kg cwt) |

Price rise in the following 3 months |

||

|

|

EYCI |

ESTLI |

EYCI |

ESTLI |

|

16 March 2016 |

547 |

507 |

32% |

28% |

Source: MLA’s NLRS

In order to answer the original question surrounding the upside potential of current prices, we must also look at how far prices have fallen from their peaks.

As of Tuesday the 19 June, the ESTLI sat at 651¢/kg cwt, just 7% below the indicator’s all-time high of 698¢/kg cwt (January 2018). On the other hand, the EYCI sat at 476¢/kg cwt, 34% below a high of 726¢/kg (August 2016).

Based on these figures, cattle prices seemingly have more room to improve than lamb prices, although sheep producers will also consider record high wool prices in any marketing decision. At Tuesday’s prices, a 350kg EYCI eligible heifer with a dressing percentage of 50% would make on average $833 in eastern saleyards. If cattle prices were to recover the full 34%, the same heifer could theoretically be worth closer to $1,120. This represents a gain for producers who managed to hold stock, but also a substantial cost to those wishing to re-enter the market.

A $287 profit sounds nice on paper, and while rainfall would undoubtedly have an immediate impact on prices, other influences must be considered. For example, in 2016, the beef herd hit a low point of 26.8 million head following three consecutive years of liquidation. When pastures started to recover, demand for young cattle drove prices to unprecedented highs. Since that time, the herd has made a slight recovery, to above 27 million head, although many producers are still operating at low capacity and will look to expand if conditions permit.

Another major point of difference since 2016 is US supply, which has risen steadily over the last two years after reaching a cyclical low.

Export demand

As around 70% of Australian beef and 60% of Australian lamb is exported, foreign demand for Australian product plays an important role in supporting Australian domestic prices. Currency is an important consideration, as when the Australian dollar falls, the global competitiveness of our exports increase. As of 19 June, one Australian dollar was buying just below 74US¢, which is the lowest it has been since May last year, and 3US¢ below April 2016 levels.

Looking to global demand, so far in 2018, demand for Australian beef and lamb has held strong in the face of historically high export volumes. For the year-to-May, lamb exports were up 14% on 2017 levels, with strong growth in the Middle East (up 30%), China (up 10%) and the US (up 8%). Over the same period, beef exports were up 15% year-on-year, driven by growth in China (up 40%), Korea (up 15%), Japan, (up 12%), while volumes to the US lifted 4% on year-ago levels.

Robust global demand for Australian red meat bodes well for domestic prices in the event of drought-breaking rain. However, growing beef export volumes out of the US and South America is expected to place some downward pressure to the finished cattle market later in the year.

To sell or to hold?

There are risks associated with both options, not least of all the uncertainty surrounding when decent rainfall will arrive and how quickly pastures will recover. Many producers have spent decades improving flock and herd genetics, so there is often more to the value of livestock than the dollar figure alone.

This article has highlighted some potential price drivers of the future and the uncertainties associated with each – it is clear therefore, there are no easy answers, but there are better-informed decisions.