Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Sheep exports and the live trade cessation

12 December 2018

Following the temporary sheep export cessation, two key trends emerged during the second half of 2018.

- Reasonable seasonal conditions and a strong wool market prevented WA export-type sheep from flooding the slaughter market.

- Some supply chains and customer markets adapted to trading conditions and increased reliance on the carcase trade.

Sheep exports recovered to 126,000 head in November following a normalisation of trading conditions. Shipments were primarily distributed between Qatar (25,000 head), Kuwait (23,000 head) and Jordan (28,000 head) while UAE and Israel, among others, also received sheep.

However, the uptick in exports is dwarfed by the foregone 500,000–700,000 head that have typically been shipped over the July-October period in previous years.

Favourable conditions keep sheep in the West

Thanks to favourable winter rain and a decent WA crop providing ample stubble feed, sheep that would have typically been exported over July–October were held on-farm, preventing slaughter floors from being overwhelmed and prices becoming depressed.

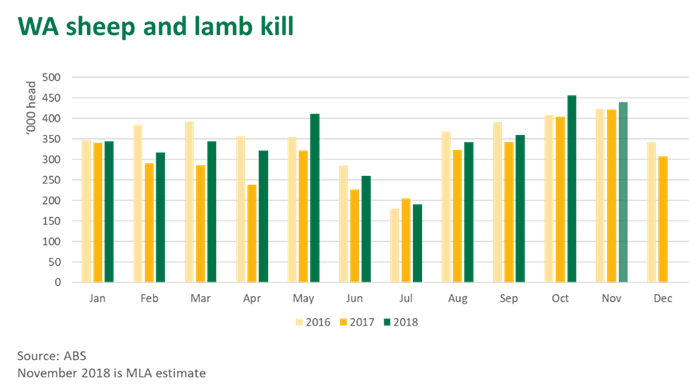

As highlighted below, the combined WA sheep and lamb kill since July has closely tracked the previous two years, when the live trade was functioning normally. Nor have significant numbers been trucked east. Likewise, while entering a mild seasonal decline, the WA saleyard mutton and trade lamb price indicators have averaged 4% and 13%, respectively, above year-ago levels since July (in fact, the WA trade lamb indicator broke records in August).

Producer appetite to hold onto stock was further fuelled by a very strong wool market, which peaked in September, albeit softening more recently. In a state where live exports account for almost a third of turn-off, the advent of tougher seasonal and market conditions would have likely provided a very different outcome.

Carcase trade expands

Following the cessation of sheep exports to the Middle East, the carcase trade recorded significant growth. However, as highlighted by the lack of WA slaughter uptick, few export-type sheep would have supplied this trade. Rather, the influx of coinciding spring lambs in the east and west underpinned growth in carcase exports.

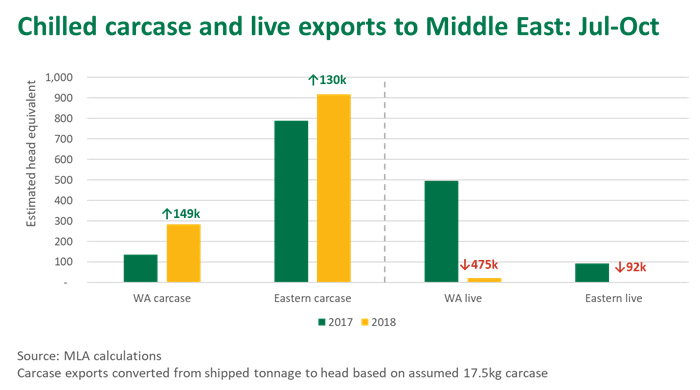

Over July–October, chilled lamb and mutton carcase exports to the Middle East out of WA more than doubled on year-ago levels, to almost 5,000 tonnes shipped weight (swt), or to an estimated 284,000 head on an assumed 17.5kg average carcase weight, while shipments out of the eastern states increased 17%, to 16,100 tonnes swt (or an estimated 918,000 head).

While chilled carcase exports to the Middle East expanded by an estimated 280,000 head during the period of the live cessation, the additional trade would have only offset about half the number of live sheep that would have otherwise gone to the market.

Furthermore, some markets managed, or opted, to adapt better than others while some contracted. Australian chilled carcase exports to Qatar expanded an additional 209,000 head over July–October – comparable to the size of the live trade over the period in recent years.

Chilled carcase shipments to Kuwait and the United Arab Emirates only increased by 27,000 and 16,000 head, respectively, despite a usual live trade 170,000–260,000 and 50,000–80,000 head to either market over the same period in recent years.

Chilled carcase exports to Jordan contracted by an estimated 49,000 head, with the market likely covering the shortfall with live imports from Europe.

In addition, the conclusion that the region has simply switched from live to carcase is somewhat skewed by the growth of chilled carcase exports to Iran, which expanded by an estimated 92,000 head over the July-October period but was not a pre-existing live export market.