Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

South America expands beef footprint in China

29 August 2018

Australia is facing greater competition in key exports markets, the flow-on effect of major beef producing nations recording rises in production.

US beef production has continued to climb throughout 2018, permitting exports to reach a record 980,000 tonnes swt in 2017-18. Increased US presence has been particular evident in North Asia – exports to Japan increased 16% in 2017-18 and shipments Korea were up 14% (roughly back on par with levels pre-discovery of BSE in the US).

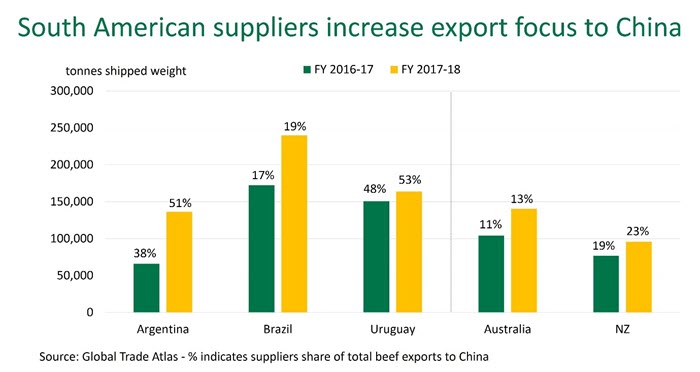

Meanwhile, beef production in all major South American suppliers increased last year and the region is forecast to produce more beef over the next two years, further expanding their export footprint as a result. One likely recipient of additional supply from South America is China, one of Australia’s fasting growing export markets so far this year.

So how did the South Americans perform in 2017-18?

Argentina

Argentina has been rebuilding its beef herd and exports after years of decline, with the latter supported by the removal of export taxes on agricultural products at the end of 2015 and a significant devaluation in the peso.

Regarded as a premium supplier of high quality beef in South America, exports from Argentina in 2017-18 totalled 265,000 tonnes shipped weight (swt), 53% larger than the previous year.

In the mid-2000s, Russia was the largest recipient of Argentine beef. However, following the policy-induced decline in trade after 2010, China has since emerged as Argentina’s largest market. Beef exports to China in 2017-18 totalled 136,000 tonnes swt, more than double that of the year prior and accounting for 51% of total beef exports.

Moreover, the economy in Argentina is in the middle of a pro-market reform program, with the aim to reverse years of protectionism and high government spending. However, the prospect of recession appears inevitable with inflation above 20% and a recent lift in the benchmark interest rates to 45% – now the highest of any country in the world – in order to curb the sustained depreciation of the peso. Since the turn of the year, the Argentine peso has lost close to 40% of its value. A much weaker peso has made Argentine exports more competitive and supported demand from major trading partners.

Argentine beef exports in July totalled 31,600 tonnes swt, the largest calendar month since November 2009. Monthly exports to China surpassed 17,400 tonnes swt – a record for Argentine exports to this market. Furthermore, in early 2018, Argentina and China signed an agreement permitting the supply of chilled bone-in beef, making Argentina the only South American country allowed to supply chilled product to China. Despite no chilled shipments having yet eventuated, the prospect of greater competition from Argentine beef is ever present.

Brazil

Brazilian beef exports continued to rise during 2017-18, and shipments to China followed suit, supported by a production increase, strong Chinese import demand and favourable currency swings. A lack-lustre economy and sluggish domestic demand has also supported the increased availability of product for export. Brazilian beef exports during 2017-18 reached 1.2 million tonnes swt, up 20% year-on-year (even with the impact of the nation-wide trucker strike that saw June exports collapse). Exports to China lifted 40%, to 240,000 tonnes swt and the markets share of Brazil’s exports increased from 17% to 19%. China now ranks as Brazil’s second largest market, behind Hong Kong, but the trade is entirely comprised of frozen commodity beef.

Uruguay

Uruguayan exports in 2017-18 were unchanged from the year prior, totalling 311,000 tonnes swt as beef production eased in the second half of the year. Uruguay’s largest export market is also China, with 164,000 tonnes swt exported in 2017-18, an increase of 9% compared with last year. Similar to Argentina, more than half of all Uruguayan shipments are destined for China, at 53% of total exports in 2017-18. As a high quality producer in South American, Uruguay has opportunity to target high value beef markets, underpinned by a national cattle identification system, strict sanitary standards, and extensive transparency along the supply chain. However, with limited production growth and restricted access to some of Australia’s higher value markets, competition from Uruguay for now is largely limited to China.

South American future trade

South America’s political and economic landscape, and susceptibility to commodity markets and currency swings, creates an element of uncertainty for trade out of the region. However, with an increasing global appetite for beef, South America will play a significant role in meeting this demand and will continue to compete against Australian beef exports. Brazil, the beef powerhouse in the region, will continue dominate the commodity market. However, Argentina and Uruguay are positioned to target higher value, even chilled, markets – with the former expanding under a liberalised export market, the latter constrained by supply, and both restricted by market access barriers. Meanwhile, ongoing negotiations between the EU and Mercosur (Argentina, Brazil, Uruguay and Paraguay) could see further competition in the future from this emerging bloc in one of the world’s highest value markets.