Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

US beef supply surge

18 April 2018

US beef production is on course to exceed 12.5 million tonnes in 2018, according to the latest United States Department of Agriculture (USDA) projections. This figure would represent a 5% production increase compared to last year and could be the third consecutive yearly expansion.

A recovery in the US cattle herd comes as no surprise – given its cyclical nature – however, production levels have lifted more sharply than previously forecast. Poor moisture conditions in a number of the largest cattle producing states, along with sustained drought conditions in the Northern Plains have driven more cattle onto feed. Feeder cattle imported from Mexico are also being placed directly onto feed as result.

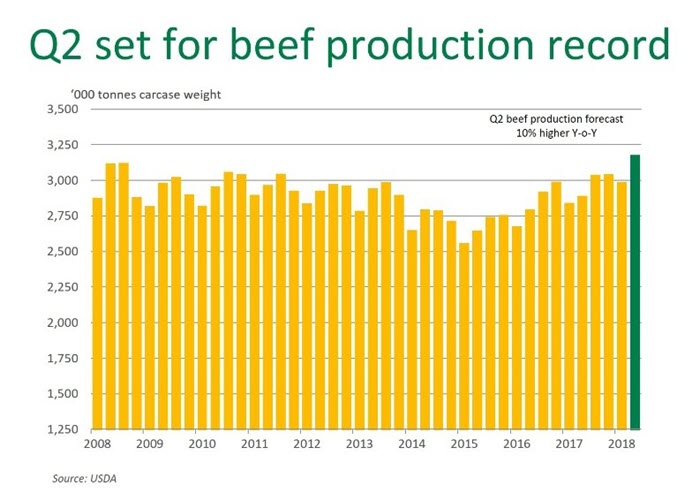

Second quarter (April–June) US beef production is set to be the highest quarterly volume for 15 years and will mark the biggest second quarter on record.

The next USDA cattle on feed report is scheduled for release this week (20 April). Steiner Consulting are estimating a 24% increase year-on-year in the supply of +120-day cattle on feed. Feedlot inventory as at 1 March was an estimated 11.7 million head, the largest number on feed March inventory since March 2006.

A combination of robust global demand for beef and a growing appetite for beef from US consumers has kept pace with the US production wave. USDA forecasts also report a domestic per capita consumption increase of 3%, to 26.8kg retail weight. US domestic demand remains strong and positive retail features heading into the peak demand grilling season support this perspective.

However, additional US beef production underpins a forecast 5% increase in US exports. Shares of this volume increase will be destined for some of Australia’s key export markets, such as Japan and Korea.

US exports

US beef exports (including offal) for the calendar year-to-February (latest data available) totalled 206,000 tonnes shipped weight (swt), up 10% from the first two months of 2017. The latest USDA statistics show an 18% lift in exports to Korea, at just over 33,000 tonnes swt.

In contrast, exports to Japan edged 4% lower year-on-year, impacted by the temporary 50% frozen beef tariff applied to ‘non-EPA’ nations (inclusive of the US, NZ and Canada) following safeguard volumes being triggered in July 2017.

However, after 31 March, the tariff on frozen beef exports to Japan reverted to 38.5%. As discussed in an earlier article, Australia traded outside these tariff changes over this period due to the Japan-Australia Economic Partnership Agreement.

Noteworthy increases for US beef exports for the calendar year-to-February include:

- Mexico at just below 40,000 tonnes, up 10% year-on-year

- Hong Kong at 22,800 tonnes, up 41%

- Taiwan at 8,100 tonnes, up 25%

- South America at 5,300 tonnes, up 68%

- ASEAN (Indonesia, Philippines, Vietnam) at 6,800 tonnes, up 42%.

Beef outlook

Australia’s major export destinations will receive greater volumes of US beef, as US production approaches record levels, especially over the next three months. However, if robust US consumption maintains pace in the lead-up to the grilling season or if the Australian dollar weakens, Australian product will continue to be well-placed in key markets.

In recent weeks, the 100-day grainfed steer over-the-hook indicator has remained at 527¢/kg cwt, as processors compete for a limited pool of quality-finished cattle destined for export markets. However, short-term US fed cattle supplies have pressured US prices lower and, if sustained, Australian prices could follow suit. The US choice fed steer declined throughout March and April, to average 334A¢/kg live weight (lwt) last week – back 6% year-on-year.