Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

EYCI rollercoaster continues

28 March 2019

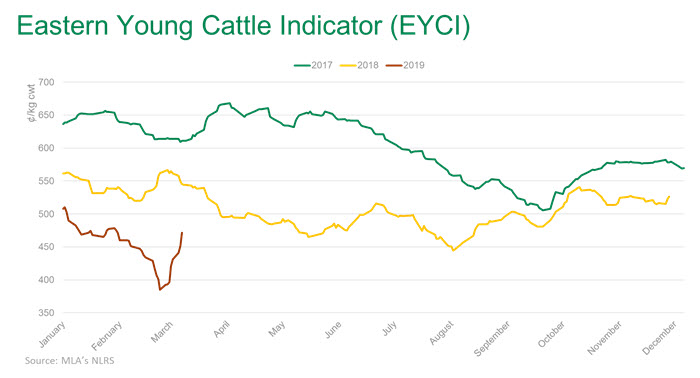

After a tough start to March, the cattle market has responded strongly. Widespread rain, with more forecast, across a large part of northern Australia in the wake of tropical cyclone Trevor has provided restocker buyers with considerably more confidence. This, combined with the lowest starting point in five years, has seen the Eastern Young Cattle Indicator (EYCI) climb rapidly over the past fortnight.

Young cattle prices

The EYCI increased 19.75¢ on Tuesday, the second largest daily increase in a full week of trading, only bettered by the Tuesday prior when the indicator jumped 24.50¢/kg cwt. A few reasons were behind this rapid correction in the market. Initially, it appeared producers were shocked by how low prices declined, with the general expectation 400¢/kg cwt was a price floor that would not be breached. When it did, there was a rapid reduction in yardings off a relatively high level – from around 20,000 head of EYCI eligible cattle supplied over a rolling week at the beginning of the month, to below 10,000 head last week. Combined with significant, widespread rainfall and more forecast over some major cattle producing areas of the country, restocker buyers have returned to the saleyards to compete with processor and feedlot buyers who were previously dominating purchases.

Whether prices continue to rise is yet to be seen, especially considering the nature of the rise over the last week. The market correction to a level above the 400¢/kg cwt mark was expected, especially on the back of rain, although the unprecedented speed of which it rose has been a surprise.

Cow prices

Similar to young cattle, the cow market has seen a recent resurgence. Tuesday’s eastern states medium cow indicator increased to 186.6¢/kg live weight (lwt), up 34.8¢ on the week before, although it still down 13.1¢/kg lwt on this time last year.

Restockers have again driven demand higher, as they look to take advantage of the low prices ahead of an anticipated rise when the season turns.

Yardings

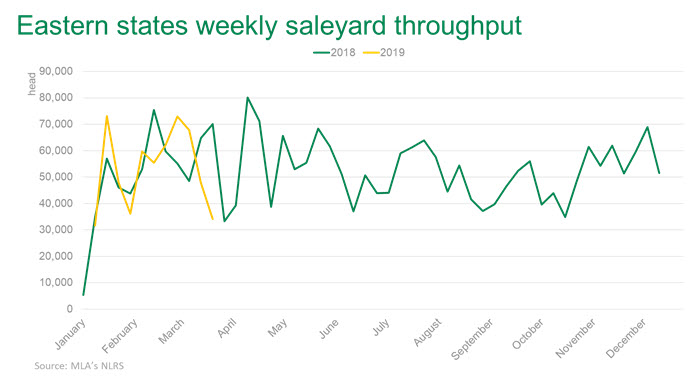

Saleyard throughput has seen a sharp decline, with last week’s eastern states yardings down 29% week-on-week and half what was available through saleyards a fortnight ago. All eastern states recorded yarding declines week-on-week besides SA which had a more substantial decline the previous week.