Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Tight supply limits goatmeat exports

15 August 2019

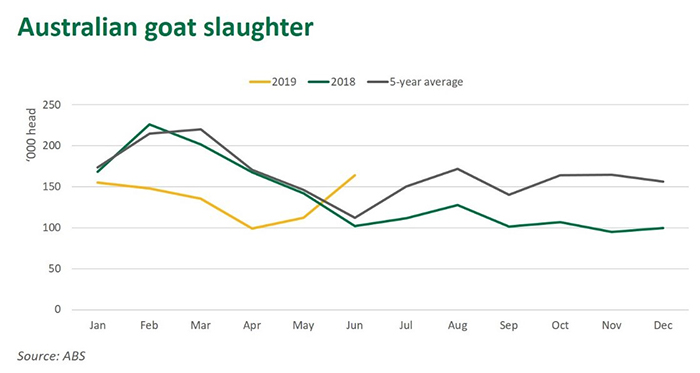

For the year-to-June (latest available ABS production and slaughter data) goat slaughter totalled 814,000 head, back 19% year-on-year and 21% below the 5-year average. The decline in slaughter throughout 2019 can be attributed to a prolonged shortage of goats, driven by a sustained period of dry conditions in the primary goat producing regions. Demand fundamentals have been robust and with limited supply out of Australia – the largest exporter of goatmeat - domestic prices have responded. As a result, producers have been incentivised to harvest their goats, as prices surged to record levels.

Given the sharp decline in slaughter, goatmeat production for the year-to-June has decreased 21% compared to 2018 and exports volumes have followed suit. Goatmeat exports for the year-to-July have totalled 12,400 tonnes shipped weight (swt), a decrease of 15% year-on-year. The US remains the largest market for goatmeat exports, accounting for 71% of exports so far in 2019 - Taiwan, Trinidad and Tobago, South Korea and Canada are also key export markets. Exports in July reached the highest levels since March 2018, totalling 2,500 tonnes swt, underpinned by the uptick in slaughter, a favourable Australian dollar and strong US demand.

For the week of 12 August, goat over-the-hook (OTH) indicators were recorded at 902¢/kg carcase weight (cwt), an increase of 61% (or 342¢) from year-ago levels. Goat OTH indicators peaked at 940¢ at the end of June, with individual processors offering up to 1,030¢/kg cwt. As goat producers develop an understanding of the value to be gained from retaining breeding does, there are additional sales channel emerging, resulting in increased competition between processors and restockers.

© Meat & Livestock Australia Limited, 2019