Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Feeder weights and prices continue to break records

18 March 2021

Key points:

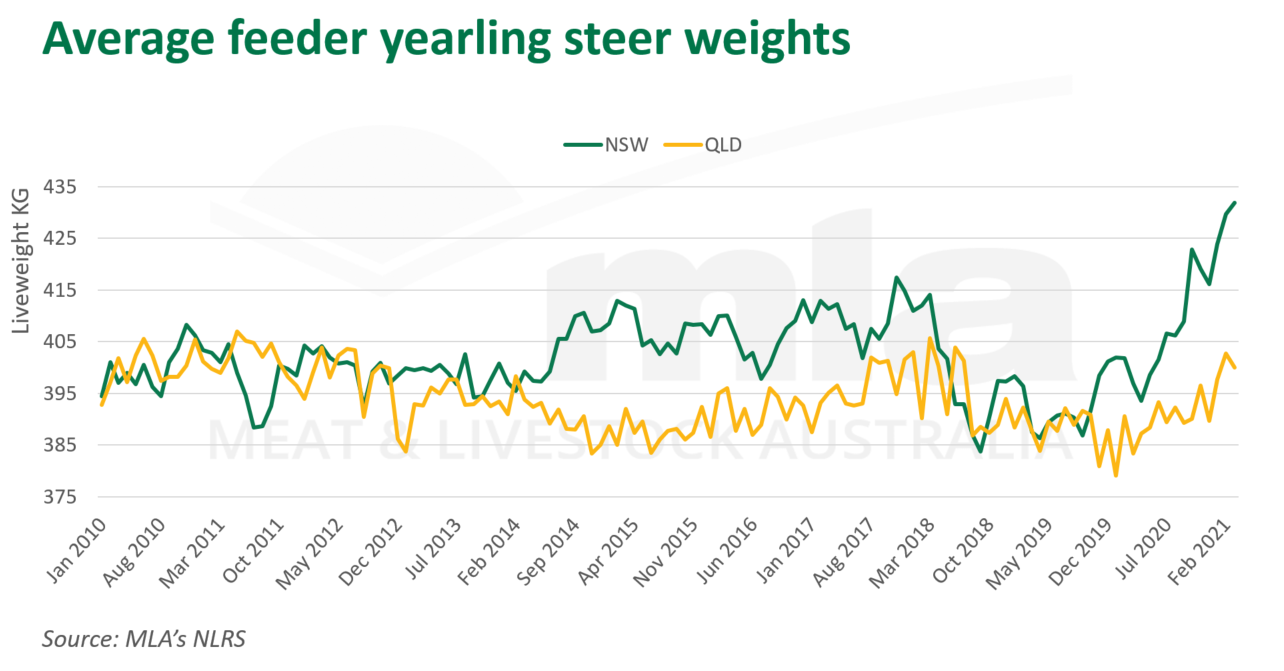

- NSW feeder weights increase by 9% (35kg) on year-ago levels

- High cattle prices and understocked paddocks are driving higher feeder entry weights

- Feedlot sector will continue to drive finished cattle production in 2021.

The recent rise of feeder weights in the last 12 months, particularly in NSW, has been unprecedented. According to NLRS data, average feeder yearling steer weights in NSW have risen 9% (35kg) since March 2020 to date, averaging 432kg liveweight for the month of March 2021. While this doesn’t sound like a large climb considering that the feeder cattle spec traditionally has limited capacity to move due to the consistent nature of lofted production, it is significant in the context of history. Understocked paddocks and an upward price frenzy in 2020 have triggered larger weight gains for greater $/head returns, cascading through to the feeder level. While Queensland cattle have experienced some weight gain, it hasn’t been to nearly the levels of NSW.

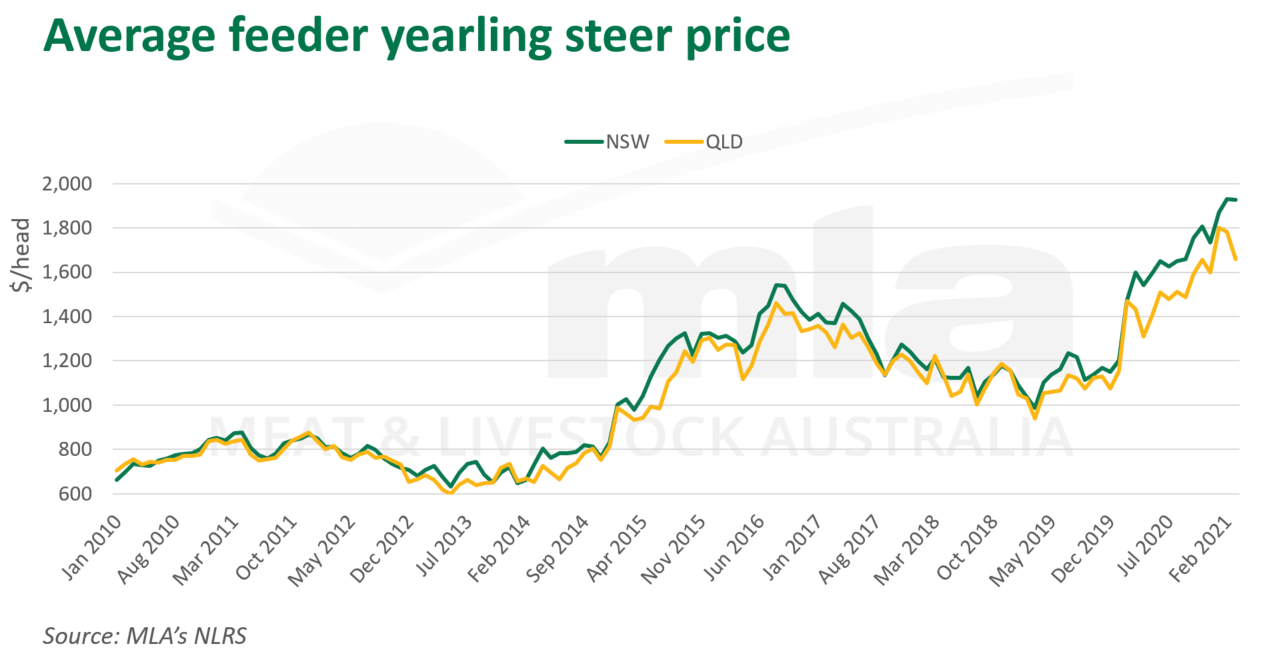

Restocker-led price premiums and increased entry weights have significantly increased prices along the supply chain. Presently, feeder cattle can be expected to fetch over $1800/head. At current prices of 430¢/kg live weight (lwt), that has meant an additional $130/head paid for cattle at a weight of 432kg compared to an average 400kg animal.

The declining grain price throughout 2020 would have assisted feedlotters, especially with finished prices following a similar upwards trend as feeder cattle. However, pressure on the export market and an inability to export higher volumes will dampen feeders' profits as margins become tighter, reducing the effectiveness of lower grain prices. The impact would vary dependent on scale of feedlot and composition of grainfed programs.

As supply of young cattle continued to dwindle in NSW and prices surged, some southern operations may have been incentivised to buy lighter to background in order to secure supply and capitalise on lower feed prices. However, this hasn’t been reflected through the increasing average weights. There were still over 1 million cattle on feed in 2020, according to the MLA/ALFA lot feeding brief, remaining at historically high levels, highlighting the influence of feedlots throughout the year. This is likely to continue through 2021, as retention of cattle on grass by southern producers transpires, meaning greater dependence on the feedlot sector to finish cattle.

Looking ahead

Seasonal conditions and prices will continue to drive the impact on entry feeder weights as producers weigh up when to sell. A softening market is likely to bring on lower weights as the gap between restockers and feeders declines, however, that is unlikely to occur until there is a significant correction in the market brought on by lower demand and higher supply.

© Meat & Livestock Australia Limited, 2021