May leads 2016 beef exports

07 June 2016

Australian beef and veal exports during May were the highest for any month so far in 2016, but were still 14% lower than one year earlier, at 100,844 tonnes shipped weight (swt) – Department of Agriculture and Water Resources. This is almost right on the five-year (2011-2015) average for May – 100,074 tonnes swt – which included extremes of production during herd rebuilding early on and drought-induced liquidation at the end of the period.

May often represents a high point in Australian beef production and exports, with increased cattle turnoff ahead of winter, and 2016 appears to be in a similar situation – particularly with widespread rainfall across eastern Australia in recent weeks having the potential to slow the flow of cattle to processors even further through early winter.

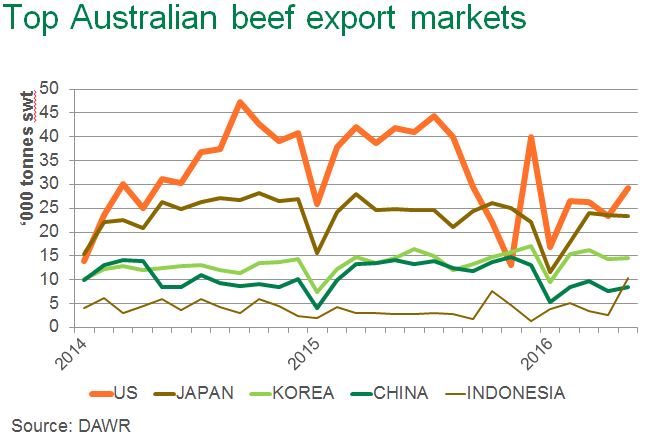

Of the 10 largest beef export markets for May, only two recorded increases in trade compared with May 2015 – Indonesia (up 269%, to 10,446 tonnes swt) and Philippines (up 65%, to 2,496 tonnes swt – growing manufacturing beef market to meet demand in quick service sector). The jump in trade to Indonesia was so pronounced that it was Australia’s fourth largest export market during May, and recorded a higher volume than trade to China for the first time since July 2012. It was also the largest monthly volume on record for beef exports to Indonesia, easily surpassing the 7,537 tonnes swt shipped in October last year. Reports from in-market suggest very strong buying ahead of Ramadan, including from Indonesian government owned enterprises, was the key factor for the record volume.

To all other major markets, limited Australian beef availability compared to one year ago continued to constrain export volumes.

- The US was the largest beef export destination during May, 30% lower than last year, at 29,325 tonnes swt, with high local production further restricting Australian shipments destined to that market.

- Exports to Japan were just 5% lower than last year, at 23,460 tonnes swt, despite growing competition from the US, as the Japan-AU EPA tariff reductions continue to support demand for Australian product.

- Trade with Korea was virtually steady with last year, at 14,474 tonnes swt – maintaining the large volumes recorded in the first four months of 2016. Assisting demand for Australian beef this year has been the third FTA cut (down to 34.7%) and short Hanwoo availability.

- There was a very large drop in beef exports to China, down 41%, to 8,433 tonnes swt, as competition from Brazil continues to challenge Australian product, particularly at the frozen lean end of the spectrum.

Australian beef exports are likely to continue tracking below year-ago levels for the remainder of 2016, with lower Australian beef production the major constraint.