Merino wool prices drop as sheepmeat demand surges

15 February 2024

Key points:

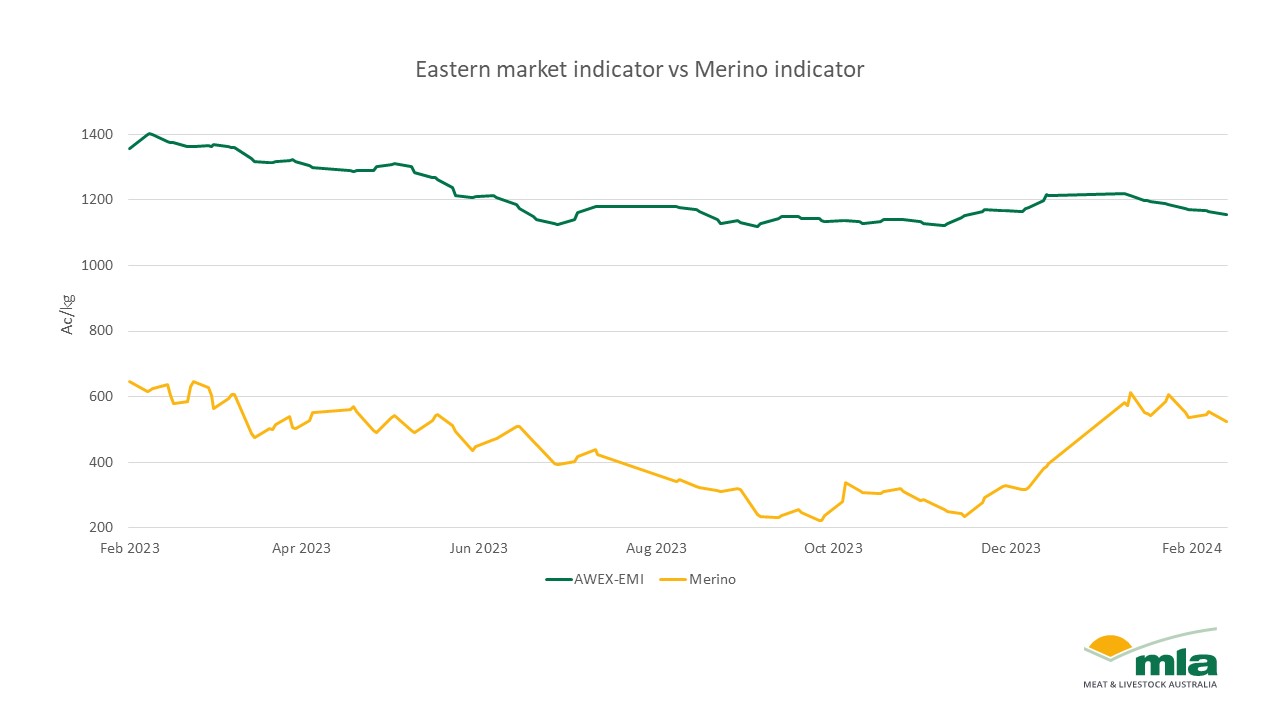

- The EMI has eased by 17% over the past 12 months.

- The difference between the EMI and Merino Lamb is decreasing.

- Concerns regarding accessing labour for wool production.

The Eastern Market Indicator (EMI), which is used to measure the performance of the Australian wool market,easing by 17% over the past 12 months. The sheep and wool market saw some major price movements over the past couple of months with the tide turning towards sheepmeat. The heavy lamb indicator has eased by 15% over the past year after starting from highs of 786¢/kg carcase weight (cwt) at the beginning of the year.

Merino wool prices have dropped consistently over the past 12 months while sheepmeat prices have shifted more drastically. Currently, the wool price is 632¢/kg above the merino indicator. This is the smallest variation between the EMI and the Merino indicator since the beginning of January, which may result in producers’ preferencing sheepmeat over wool.

There are a multitude of factors that are leading to a potential preference for sheepmeat as opposed to wool. According to the Sheep Producers Intentions Survey (SPIS), accessing skilled labour is likely to be more difficult in the next 12 months and will continue to be a problem for wool production.

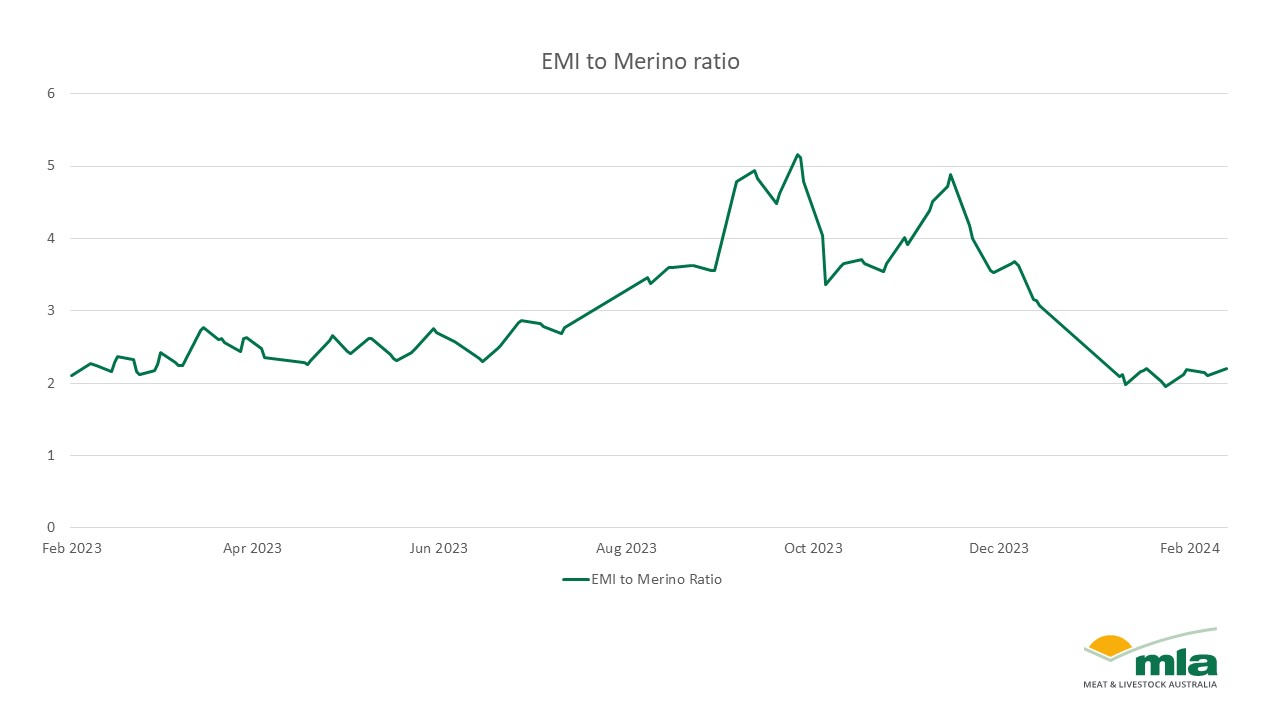

This graph shows that sheepmeat in 2024 is back in vogue. Where wool production is now only two times greater than sheepmeat, exemplifying the resilience of the lamb market. The SPIS supports this argument for sheepmeat as prime lamb is a larger part of the flock compared to Merinos, indicating a shift in producers' intentions.