Wheat environment inches closer to normal

27 October 2023

Key points:

- Australian wheat production is forecast to fall 35% in 2023-4.

- Global production is forecast to remain stable at 791 million tonnes.

- Domestic wheat prices have stabilised over the past several weeks.

The September Agricultural Commodities update from the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) is useful for understanding the global outlook for grains, especially wheat. In general, the update shows declines in Australian production, while rebalancing in other markets means that the next marketing year is set to be more ‘normal’ than the previous one.

Australian production:

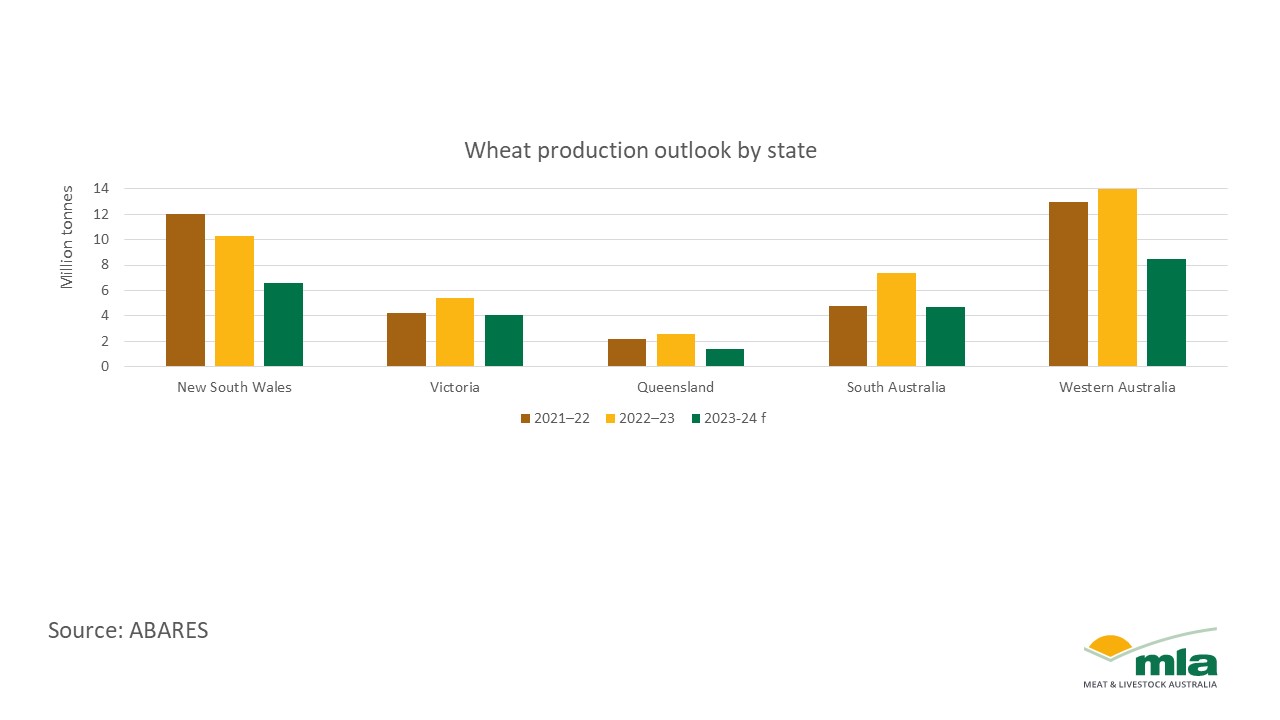

Wheat production is forecast to fall by 35%, from 39.6 million tonnes (mt) in 2022–23 to 25.3mt in 2023–24. The 2022–23 marketing year had record high production, as a combination of strong climactic conditions and high prices globally led to extensive plantings and strong harvests. The outlook on other grains looks similar. Barley production is forecast to fall from 14.1mt to 10.4mt, grain sorghum production is expected to fall from 2.5mt to 1.5mt, and cottonseed production is expected to fall from 1.5mt to 1.3mt.

While these declines suggest lower feed supply over the next year, domestic use is expected to remain relatively stable. Focusing on wheat specifically, domestic use is expected to stay relatively flat despite the large fall in production. This is because exports are expected to fall by 40.5% over 2023–24 to 18.7mt, leaving domestic supply relatively stable at 7.6mt.

Global outlook:

Wheat production is forecast to fall slightly, from 794.4million tonnes (mt) to 791mt in 2023–24. This is largely due to a 9% fall in production in Russia and Kazakhstan, which is balanced out by increased production in the USA, India and the European Union.

Increased production of other crops (including rice and barley) means that total grain supply over the next year will likely to be higher than in 2022–23. However, the ongoing Russia-Ukraine war means that some production and trade will likely be disrupted.

This relatively stable outlook means that ABARES forecasts a slight reduction in global prices, from A$389/tonne to A$360/tonne. The reduction in international market prices makes export a comparatively less attractive outlet for Australian wheat, retaining stocks in the domestic market.

Prices:

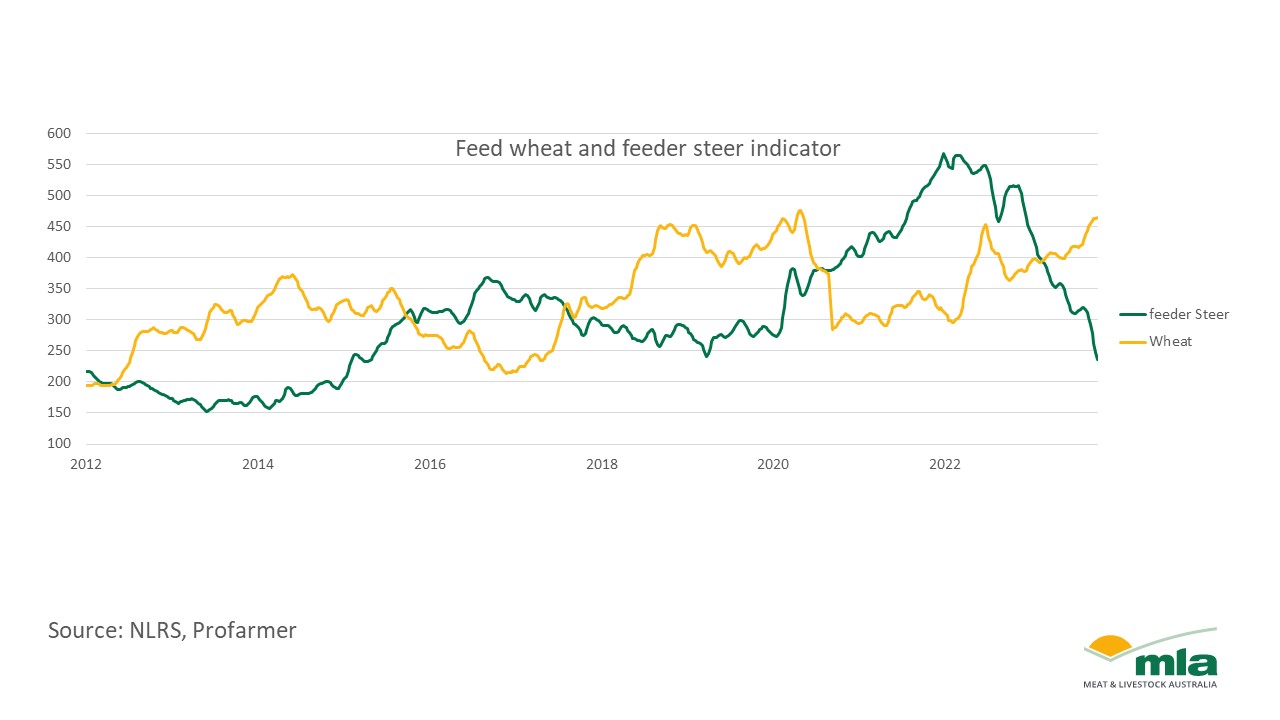

Darling Downs feed wheat has been steadily rising in price over 2023 but has not yet reached the peaks that occurred in 2020 and is well below the all-time peaks in 2008. Declines in the feeder steer price indicator mean that the feeder steer-wheat price ratio is now at its highest since 2014, suggesting that heavier, more finished cattle will likely be more attractive to feedlot buyers over the coming months as grain prices remain elevated.