Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Cattle on feed consolidate at bigger end of town

03 March 2016

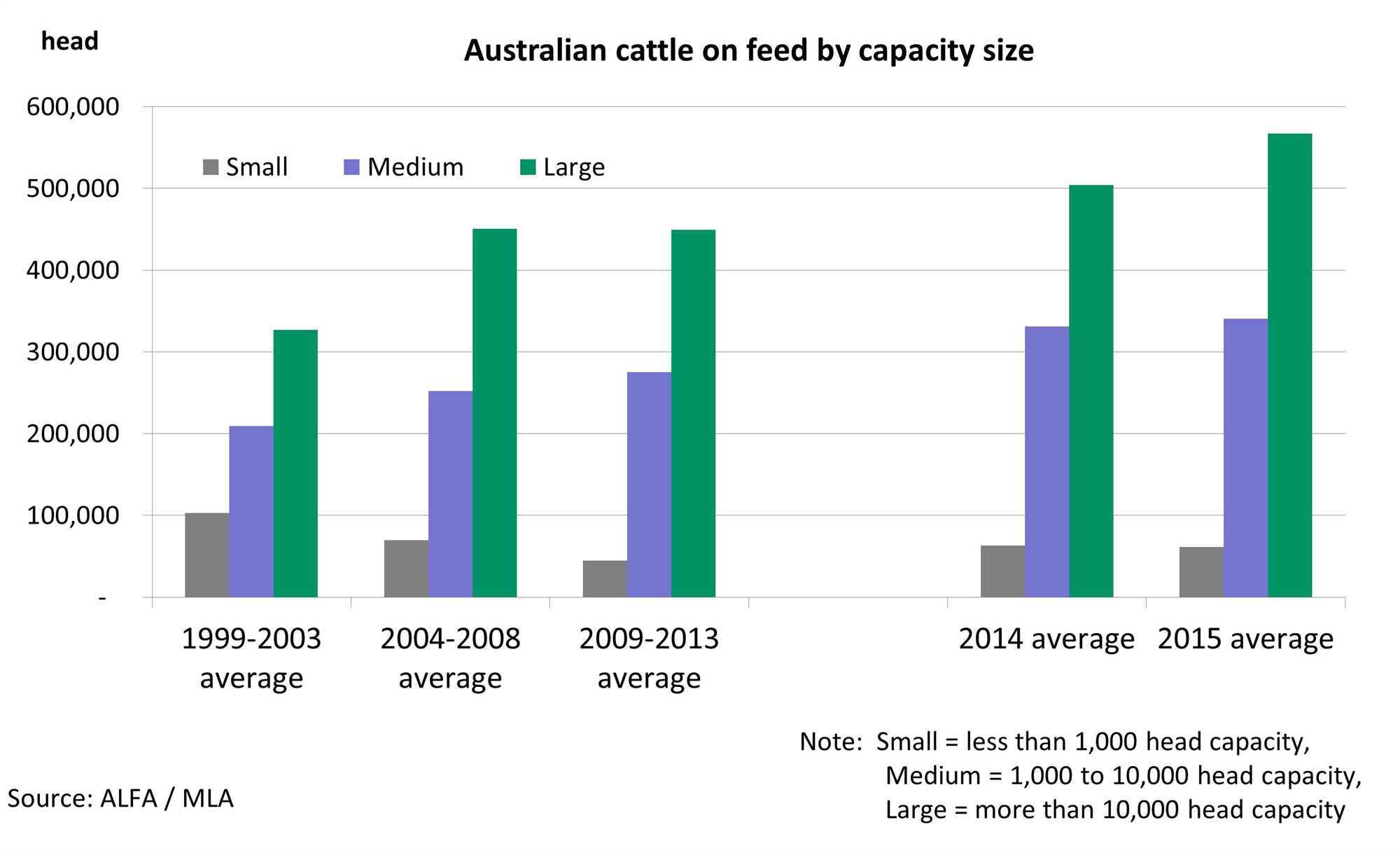

The latest ALFA/MLA quarterly feedlot survey reflects the trend over the past three years of continued growth in cattle numbers on feed at the larger end of the feedlot sector.

Results from the quarterly feedlot survey indicated cattle on feed were at a record high at end of 2015, at just fewer than one million head. The growth came from the largest feedlots (more than 10,000 head capacity), particularly in NSW. The smaller end (less than 1,000 head capacity) actually declined on the previous quarter and medium sized feed yards (1,000-10,000 head capacity) were close to steady. In the short term, this is the result of a competitive feeder cattle market environment, and the ability of larger feedlots to outbid the smaller players, and the reduction in opportunistic smaller operations using the feedlot as a drought mitigation tool.

As illustrated below, cattle on feed jumped in the mid-2000s, when the US was temporarily banned from exporting beef to Japan and the Australian grainfed industry expanded rapidly. Between 2000 and 2005, smaller feedlots went from accounting for 16% of the cattle on feed to just 9%, while large feedlots increased from 52% to 58%. These trends have continued to this day.

As of December 2015:

- Large capacity feedlots accounted for nearly 612,000 head, 61% of the national total

- Medium capacity feedlots accounted for just over 341,000 head, 34% of the national total

- Small capacity feedlots accounted for almost 45,000 head, 4% of the national total

Putting the Australian record number of cattle on feed into context, data recently released by the United States Department of Agriculture (USDA) put the start of February US cattle on feed inventory at 10.7 million head, steady on the previous year but up slightly on where it sat the month prior. While the US cattle feeding industry is ten times larger than that in Australia, it is still historically low, and Australia has remained competitive in the high value grainfed beef markets of Japan and Korea, assisted by currency movements.