Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Australia a global leader in efficient cow-calf production

14 February 2018

Key points

- Global competition is heating up from the US and Brazil.

- Australian cow-calf enterprises are among the most efficient in the world.

- A large portion of the cow-calf cost advantage is lost when it comes to finishing cattle.

Australia produces beef in an increasingly competitive global environment. As highlighted in the recently released MLA 2018 Cattle Industry Projections, both the US and Brazil are expected to expand beef production and exports over coming years.

Are Australian producers remaining cost-competitive with these global beef heavy weights? A recent report commissioned by MLA in conjunction with the global agri benchmark network goes someway to quantifying Australia’s ability to remain cost-competitive.

Australia is one of the most efficient and competitive producers of calves in the world but the playing field levels out when it comes to finishing cattle. Furthermore, Australia faces additional costs beyond farm gate that must also be factored in when assessing the industry’s ability to be globally competitive. Australia contends with some of the highest beef processing costs in the world and, unlike most producing countries, the majority of Australia’s customers are in global markets.

Australia leads the pack in cow-calf production

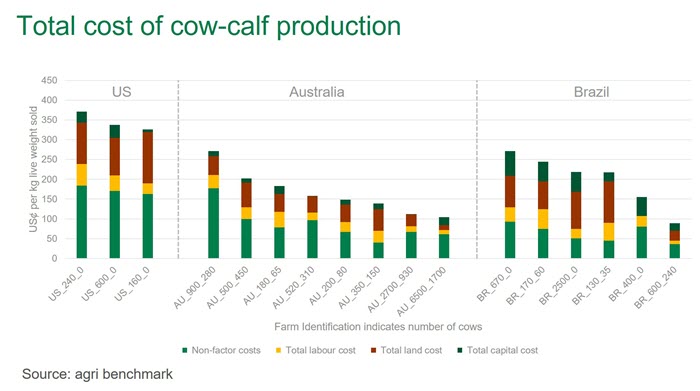

Australia hosts a very broad spectrum of production systems, which is reflected in the indicative farms selected in this comparison analysis*. As illustrated in the chart below, the cost of producing 1kg of beef at the cow-calf level in 2016 ranged from US272¢ down to US105¢. Even the most costly cow-calf enterprise in Australia was still US54¢/kg below the most efficient in the US. Furthermore, most Australian cow-calf operations are more cost competitive than their Brazilian counterparts.

Despite high labour costs, Australia’s ability to compete is largely underpinned by its labour efficiency – brought about by economies of scale and one labour unit serving a large number of cows. The cost of land per unit of beef produced at the cow-calf stage in Australia is lower than in all US and most Brazilian enterprises. Australia also has lower ‘non-factor’** costs in comparison to the US, primarily made up by lower feed and machinery expenses.

Finishing cattle levels the playing field

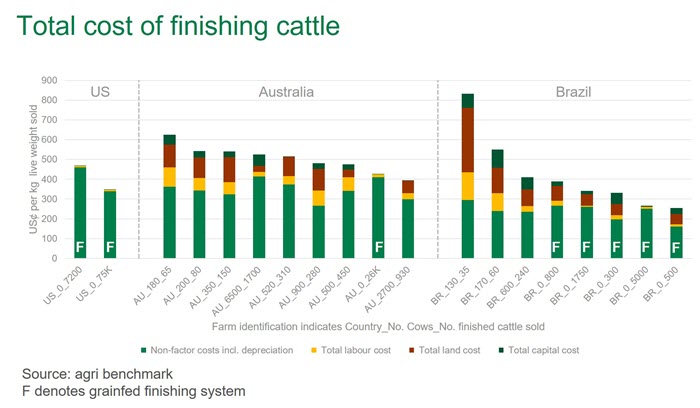

A large portion of the cow-calf cost advantage is lost when it comes to finishing cattle. Being a predominantly grass-based production system, Australia lags North America’s grain finished industry for average daily weight gain and similarly against much of Europe’s silage-based systems. In general, southern Australia’s grass finishing systems can place on more kilograms per day than Brazil, but northern systems are comparable or on a lower base than their South American counterparts.

However, the one Australian feedlot included had amongst the highest average daily weight gains in the global study, primary due to a shorter feeding regime than those in North America.

In addition, young cattle prices in 2016 (period of analysis) reached record high levels in Australia and were out of step with North and South America, further lifting Australia’s comparative cost base for finishing cattle. While overall feed and cattle purchase costs are generally lower in Australia than the US, almost all other costs swing the other way. Furthermore, although some Australian beef producing operations are comparable to Brazil, the higher cost of cattle, land, machinery, labour and taxes in Australia leaves most cattle finishing enterprises on a higher cost base.

Costs accrued further down the supply chain, in processing cattle and getting beef to consumers, are more difficult to quantify but are likely higher in the case of Australia – due to the higher cost of labour and energy and the freight bill attached to most consumers being in international markets.

Nevertheless, raising and finishing cattle will likely remain the most significant cost – and most volatile due to the impact of weather – in the Australian beef supply chain.

Therefore, Australia must remain cost-competitive in the long-term with the likes of the US and Brazil, or continue to seek out and defend its share in premium markets. Fortunately, Australia already receives a premium above the commodity market, with its exports underpinned by world leading quality assurance, traceability programs and favourable market access.

*Instead of analysing industry averages, the approach taken by agri benchmark is to select enterprises that are indicative of the spectrum of production systems within a country.

**Non-factor costs include all the operating costs of the enterprise, both variable and allocated fixed costs.