Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

US imported beef prices steady

12 March 2018

US imported beef prices eased this week, as trading conditions between overseas packers and US end users remain largely subdued.

The imported 90CL beef indicator was unchanged in US$ terms at 212US¢/lb CIF (down 1A¢ to 598.95A¢/kg CIF).

Ongoing supply constraints out of both Australia and New Zealand has been further heightened in recent weeks by improved moisture conditions. Ample rainfall across many key supply regions of Queensland has reduced the number of cattle being turned off. Good moisture conditions in New Zealand in the last few weeks looks to have delayed the seasonal increase in cow slaughter.

As demand for grinding beef seasonally peaks in the months ahead, a topic of discussion has been how frozen imported prices might be affected by a shift towards fresh beef by large US end users, whom buy directly from Australian suppliers. At this stage, the market appears divided on how prices might trend and the focus remains on the availability of imported product for delivery in May and June.

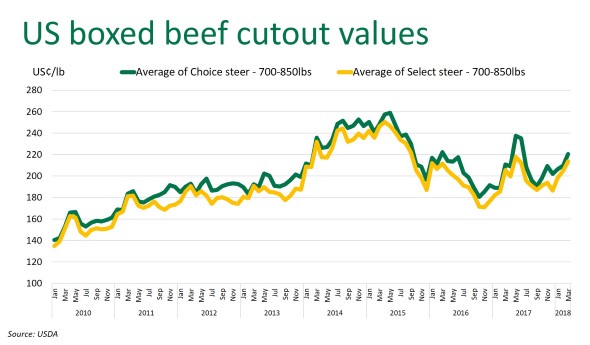

Robust US beef retail features continue, with activity reported 9% higher than the five-year average. Improving retail features have also supported wholesale beef prices, reflected in higher cutout values. The choice beef cutout, at 224.14US¢/lb, is 10US$ higher year-on-year. Beef demand in the US is in excellent shape and the increase in beef features at retail should drive an increase in consumer traffic.

Highlights from the week ending 9th March:

- CME fed cattle futures remain particularly volatile, with prices down sharply mid-week only to recover much of the lost ground on Friday

- Fed cattle slaughter in the last four weeks has averaged 465,000 head per week, 1% higher than a year ago and less than many were projecting for this time of year

- Non-fed slaughter in the last four weeks has averaged 128,000 head, 4.9% higher than a year ago. Non-fed slaughter seasonally declines in March and April, which could help bolster 90CL values in the near term. Seasonally ground beef demand also tends to improve in the spring.

Click here to view the Steiner Consulting US imported beef market weekly update.