Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

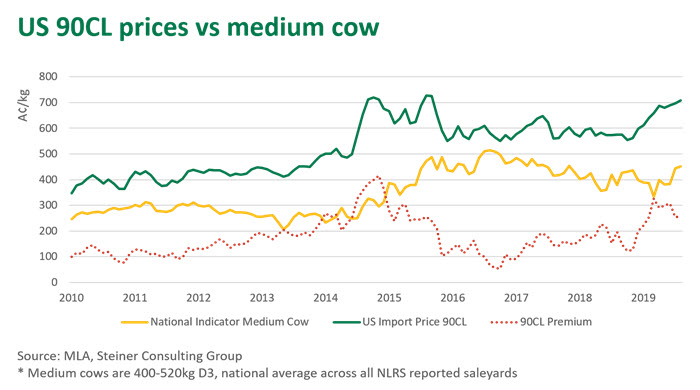

Medium cow price closing in on 90CL premium

22 August 2019

The medium cow indicator continues to close the premium on lean grinding beef prices (spread between the saleyard medium cow indicator and US imported 90CL indicator), despite global conditions pushing the 90CL indicator towards record levels. The gap has closed to 257 A¢/kg so far in August, back from margins over 300¢ seen through March-June.

US market highlights this week:

- US choice beef cut-out price jumped 10% following Tyson Foods fire in Garden City, Kansas

- US slaughter trending upwards, leading into Labour Day strong demand

- NZ beef supply sits in a seasonal lull while demand from Asia at all-time high

Strong US domestic demand has helped drive 90CL prices upwards over the last few months. Historically, high 90CL prices have had a positive impact on Australian cow prices and provided relief when turnoff levels are elevated. As discussed last week, female turnoff is currently sitting at a historic 58%. Typically the Australian medium cow indicator responds to movements in the 90CL price, which, if current US demand holds, should support Australian prices going forward.

Turbulent domestic factors have had a significant influence on the US beef market over the last month. Fire swept through a major US slaughterhouse, forcing their operations to close for a number of months. The Tyson Foods plant in Kansas kills approximately 6,000 cattle a day, accounting for 5% of total US slaughter, and processing is not expected to resume until the end of the year. The fire has fuelled concerns over beef supply pressures leading up to Labour Day, with prices spiking as a result.

Combined with domestic US factors, the 90Cl indicator reflects a dynamic global market. While New Zealand is currently in the middle of a seasonal lull, demand for protein from Asia is drawing in much of global supply. With China taking record levels of beef from New Zealand and Australia, US import prices have been adjusting upwards to compete for product. As of last week, imported Australian lean grinding beef was trading at 708A¢/kg, a premium of 59A¢/kg over the US domestic equivalent.

Headwinds ahead for the US market include an impending end to the grilling season and domestic supply regaining traction in the back half of 2019 – cows to market are expected to increase over the coming months. Regardless, strong demand from Asia and the US exchange rate should continue to support price levels in Aussie dollars and underpin Australian cow prices.

© Meat & Livestock Australia Limited, 2019