Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Prices for NSW and Queensland cattle both climb over past year despite divergent weights

11 March 2021

Key points:

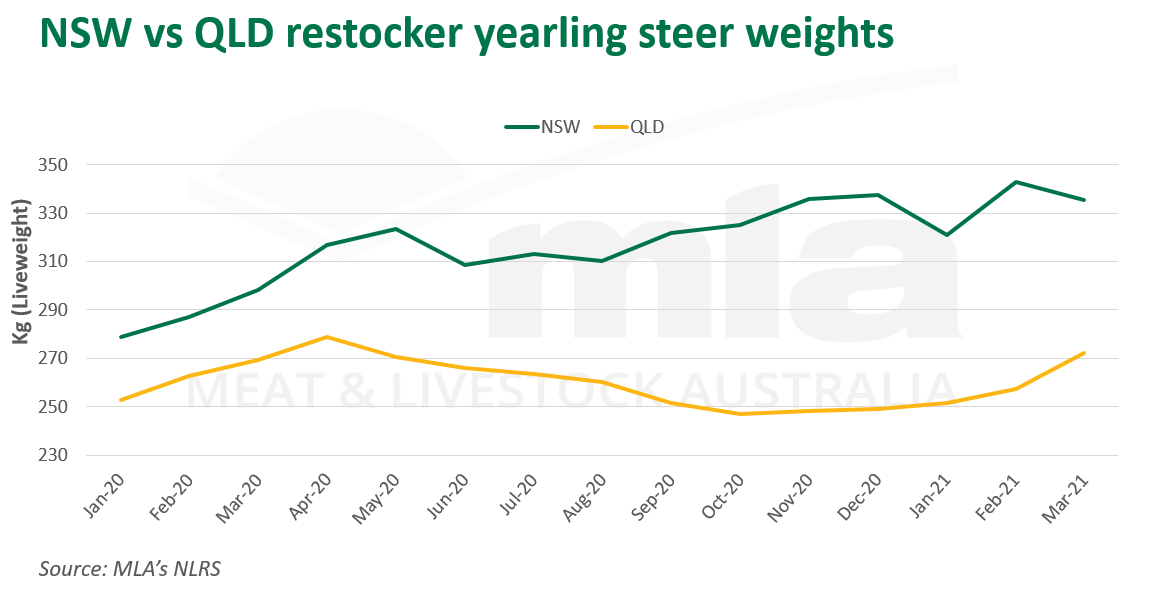

- Yearling steer weights in NSW and Queensland for 2020 reflective of season and producer demand

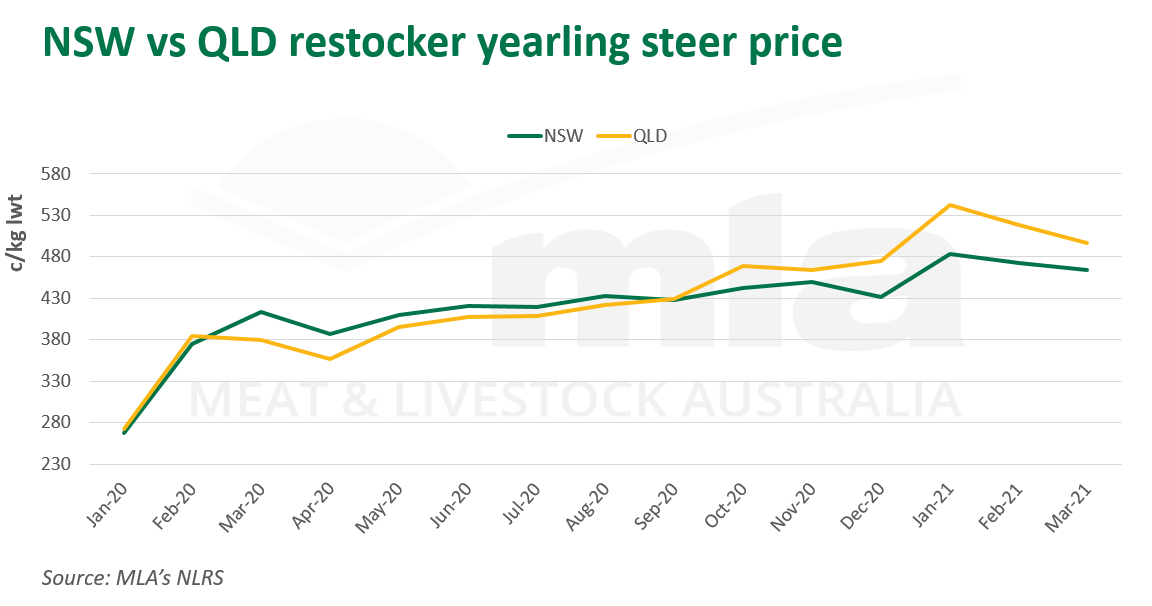

- Queensland fetch liveweight premiums for young cattle over NSW

- Decline in liveweight prices paid for restocker cattle hasn’t been enough to offset rising weights in 2021

As they did in 2020, young cattle have once again led buying trends to begin 2021, with restockers continuing to pay premiums. Analysing restocker yearling steer weights and price trends illustrates conflicting stories between the NSW and Queensland cattle markets, and what impact the season has on producer decision-making.

NSW

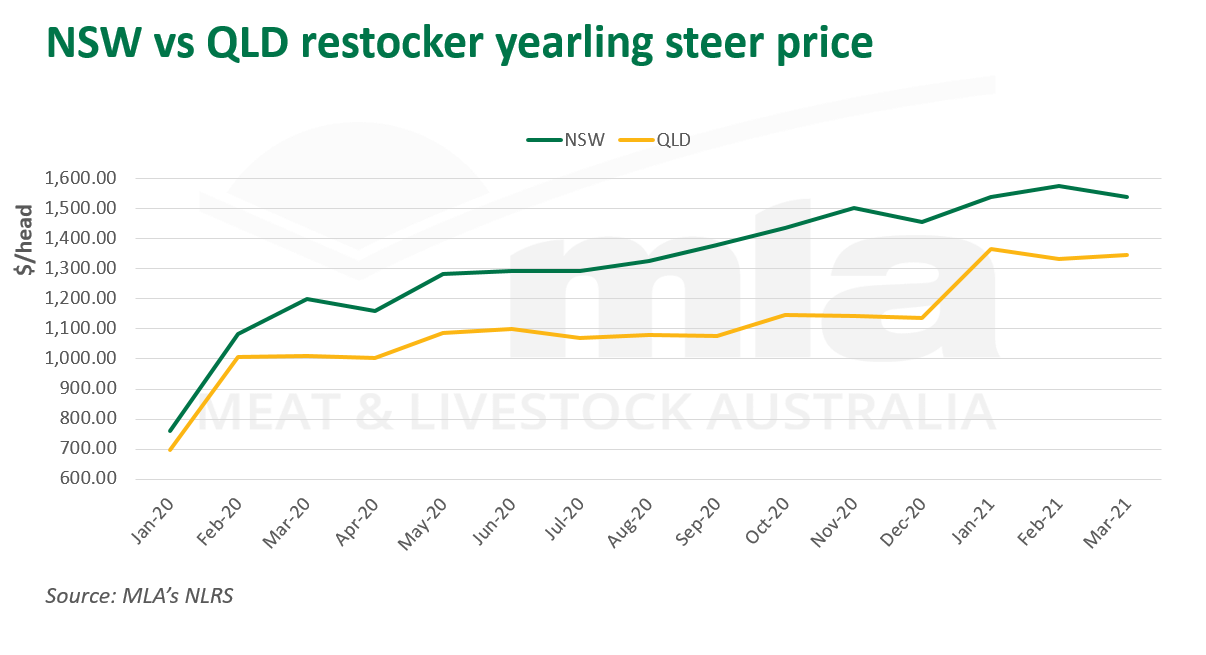

A key indicator of an improved season is the weight gain in young animals as they hit the market. Given the dramatic rise in the market in 2020, fueled by southern states’ rainfall, NSW producers have looked to keep young stock for longer to capitalise on previously unseen $/head returns (as an example, over $1500 has been paid for a 300kg steer).

Traditionally, more feed on offer would incentivise producers to grow stock out to finished weights, as, according to current NLRS data, $2200 could be expected for a 600kg steer. However, high prices driven by excessive restocker and feeder demand, along with the price disparity between young and finished cattle, have driven many producers to sell earlier.

A potential correction in the cattle market later in 2021 may also fuel earlier selling, as producers assess margins and the risks associated with growing steers out, however, this would be dependent on the type of producer, scale of operation and dependency on a productive herd for income.

Queensland

On the back of a poor season and less pasture availability in Queensland, the state saw declining young cattle weights and a widening margin between itself and NSW for most of 2020.

These light weights were driven by drought-affected Queensland producers offloading cattle to southern states to accommodate the increased demand, as southern producers buying lighter stock were able to justify transporting costs of northern cattle. The gradual decline of weights started in April, the same time there was an influx of southern buyers purchasing Queensland cattle – spurred by solid rains and low supplies of young stock across NSW.

Weights and prices telling different stories

Interestingly, despite a divergence of average yearling steer weights between NSW and Queensland, $/head prices have not deviated anywhere near the same rate, with both states continuing on an upward trajectory.

This leads to the conclusion that the liveweight price paid in Queensland has lifted at a significantly higher rate than what’s been seen in NSW, allowing the two markets to trend similarly on a $/head basis. Since March 2020, NSW and Queensland liveweight prices have lifted by 12% and 30%, respectively, with the greater rise in the north driven by the aforementioned factors.

What’s on the horizon?

Looking ahead for the year, the decline in liveweight prices paid for young cattle since record levels in January hasn’t been enough to offset the rising weights of cattle from both states, but particularly Queensland after new year rainfall.

$/head rates are at or near record levels, reflecting that despite a recent decline in the young cattle market, overall investment in restocker or backgrounder cattle hasn’t subsided.

© Meat & Livestock Australia Limited, 2021