Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Australian beef exports forecast to decline in 2021

19 November 2020

Key points:

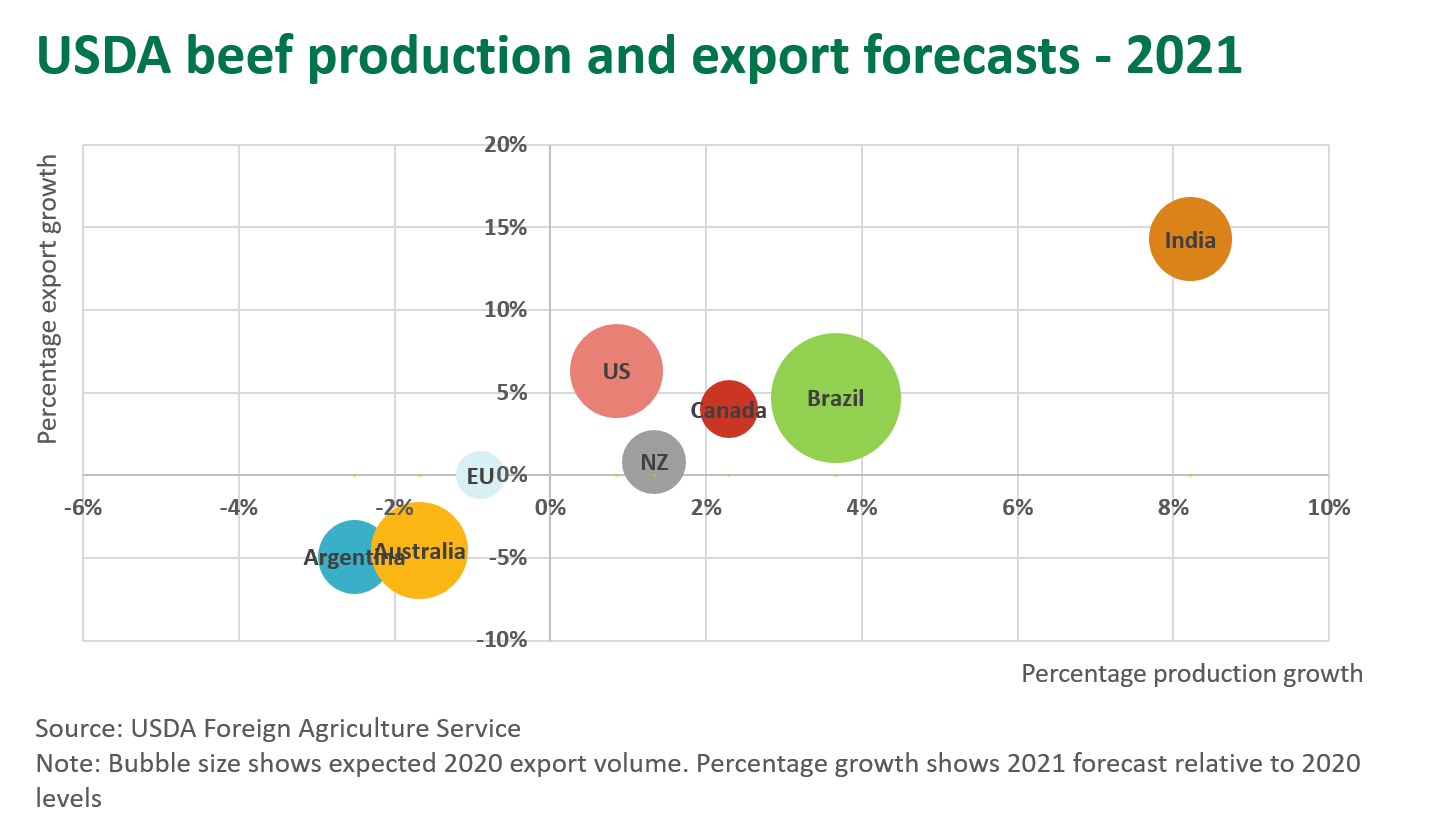

- Brazil, India and the US to lead global beef production growth in 2021

- Australia and Argentina are among the minority of nations forecast to decline in beef export volumes

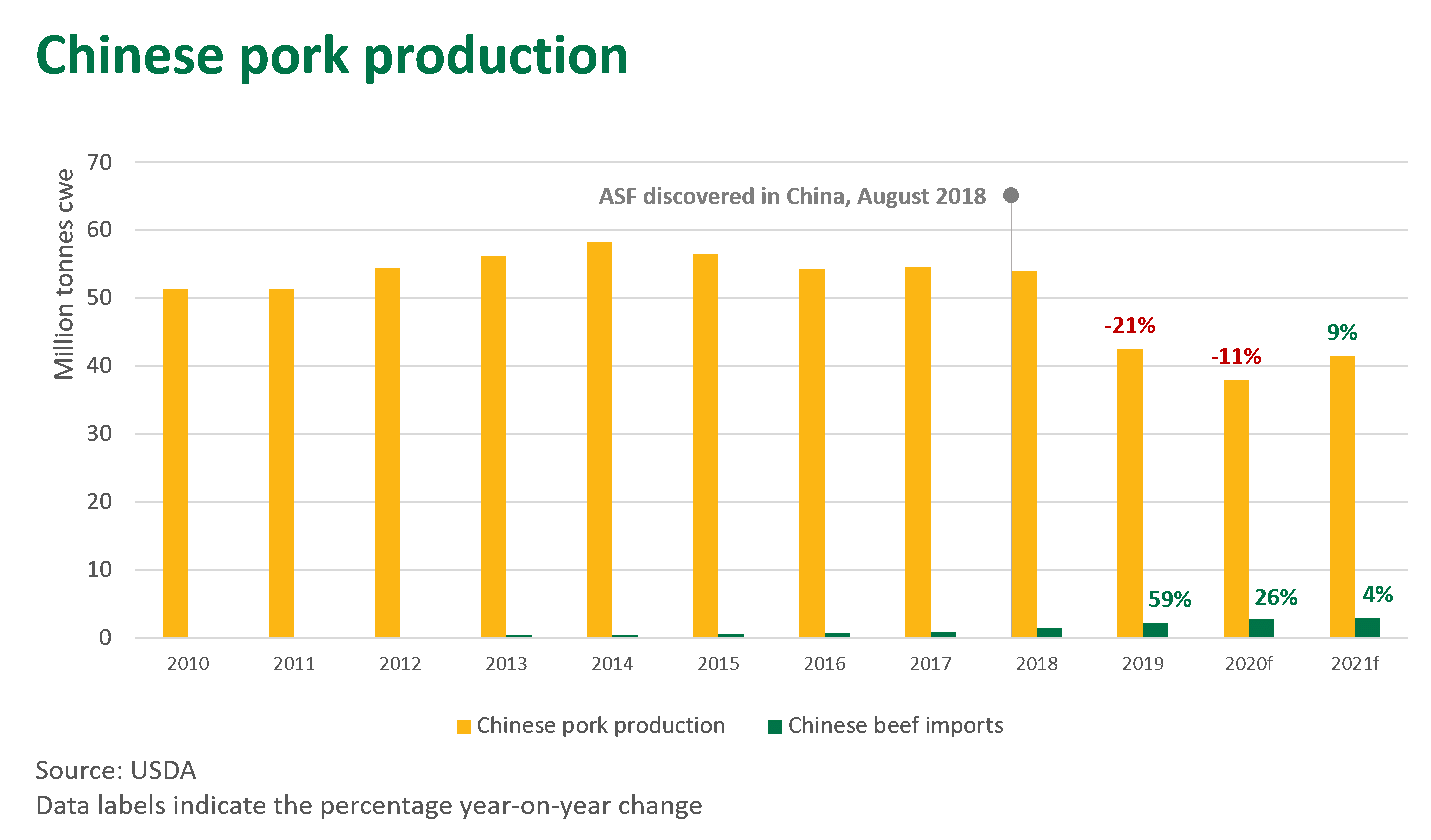

- Chinese beef imports expected to remain historically high

Last month, the United States Department of Agriculture (USDA) Foreign Agricultural Service released their Livestock and Poultry update, providing forecasts for production, trade and demand across world markets. While COVID-19 has certainly had far-reaching and likely long-term impacts upon the global meat landscape, forecasts from the USDA report indicate a return to more typical trading and consumption behaviour, particularly if the expectations around a resurgence of economic activity come to fruition next year.

Global beef production to lift in 2021

The USDA has forecast global beef production to lift to 61.5 million tonnes carcase weight equivalent (cwe), an increase of 2% on 2020 levels. This year, disruptions cause by COVID-19 have certainly challenged meat processors across the globe, essentially capping processing capacity below typical levels. With optimistic signs on the horizon, the reality of global beef production ramping up next year is likely.

Brazil has been a key contributor to global production growth in recent years, and this trend is set to continue in 2021. Beef production in Brazil is expected to benefit from improved economic activity within the domestic market, combined with enduring demand from China. Additionally, Brazilian grain feeding capabilities are building, and while feedlots currently only account for 10% of Brazil’s meat production, this is expected to double over the next five years.

After experiencing COVID-19 related processing issues earlier in the year, beef production in the US has been performing well since. USDA projections indicate that US beef production will lift in 2021, a result of heavier carcass weights and expectations for higher slaughter levels. India was also affected dramatically by COVID-19 processing disruptions and is expected to experience a lift in production as slaughter levels lift back towards typical levels next year.

In contrast, production levels in Australia and Argentina are expected to contract as producers across both nations look to rebuild herd numbers after significant periods of destocking. As in Australia, Argentina has struggled with drought through the past few years, which has resulted in elevated slaughter levels throughout 2019 and 2020.

COVID-19 recovery expected to support global demand

This year, COVID-19 has had an untold impact on global meat trade, as the typical operating environment for suppliers and consumers has been compromised. As economic conditions improve and demand from the foodservice industry re-emerges, this is expected to provide support for global demand.

While Australia isn’t in a position to capitalise on this demand from a volume perspective, the recovery of foodservice demand next year should provide some support to the overall value of the export industry. As key markets emerge from a short period of economic recession, this should positively influence global demand.

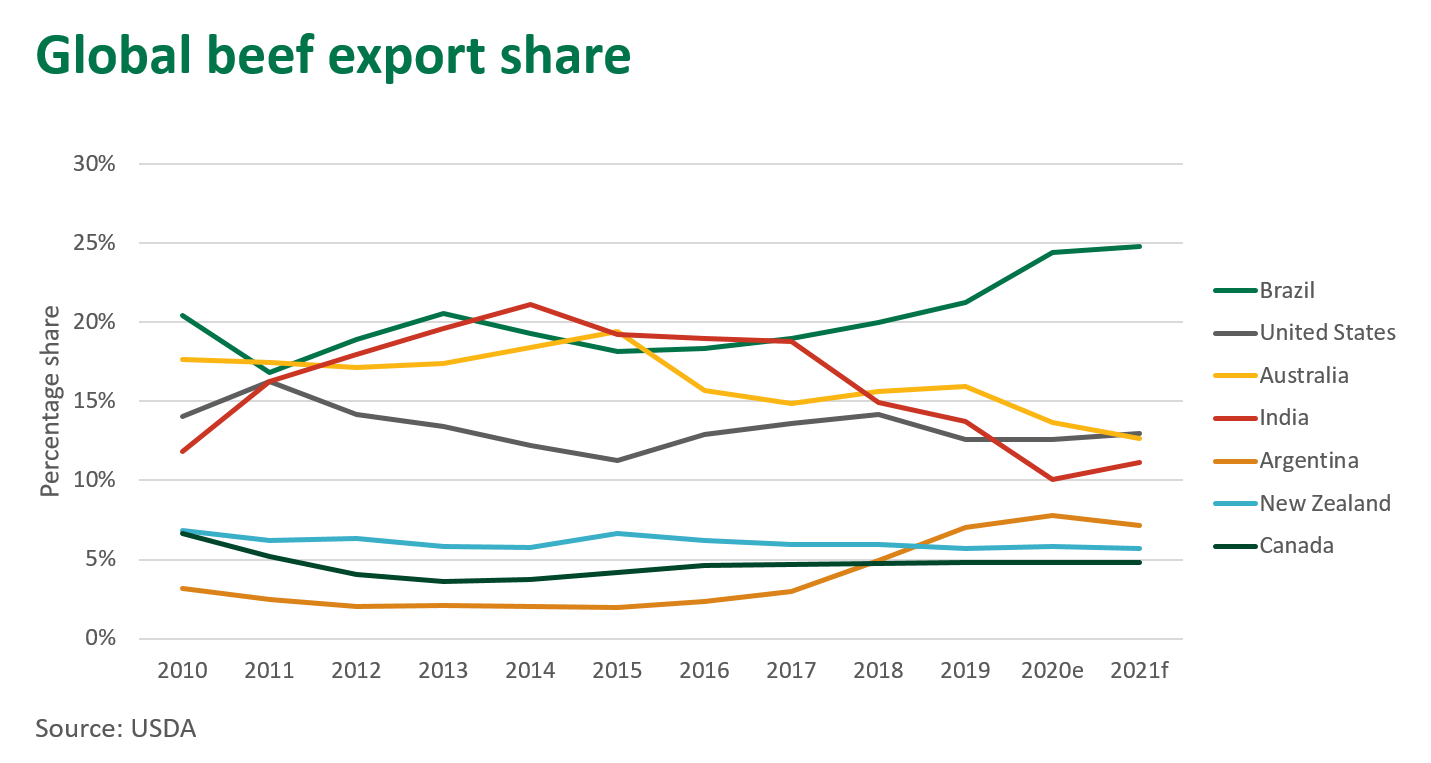

Disruptions this year have acted as a handbrake for the global beef export trade. However, for next year the USDA have forecast export volumes to lift to 10.8 million tonnes cwe, equivalent to growth of 3%. Much of this growth will be attributed to Brazil and India, however, a number of smaller suppliers, such as Canada, New Zealand, Uruguay and Mexico should also see a rise in export volumes. While Australia accounted for approximately 16% of global beef traded in 2019, the USDA forecast this to drop to 13% next year.

Import demand from China expected to remain robust

Global beef imports grew by a staggering 9% in 2019, with this growth expected to slow to 4% this year. While the impact of COVID-19 on global markets has been somewhat unfavourable for beef demand, import volumes from China – still very much fuelled by the impact of African Swine Fever – has remained a positive driver this year.

Next year, pork production in China is expected to grow for the first time since 2017, and as the Chinese swine herd recovers, the USDA expect this to slow the growth of global beef imports. Regardless, beef import volumes should remain at historical highs, given that Chinese pork production still remains well back on the typical volumes seen pre-2019. Additionally, as countries around the world move through various stages of COVID-19 recovery, this should provide support to the global beef market, as consumers emerge from lockdown eager to engage in dining out experiences again.

© Meat & Livestock Australia Limited, 2020