Slaughter trends tell two tales

28 November 2016

Underpinned by the Australian cattle herd hitting a 20-year low, cattle slaughter has been in constant decline throughout 2016. However, once grassfed and grainfed beef slaughter trends are segregated, two different patterns emerge.

As indicated in the latest ALFA/MLA lotfeeding survey for the September 2016 quarter, numbers on feed eased 18% from year-ago levels, to 788,873 head – accounting for approximately 65% of Australian feedlot capacity.

Despite the declining number of cattle on feed, grassfed slaughter has actually dropped to a greater extent, meaning that grainfed slaughter accounted for 39% of Australian adult cattle slaughter at the end of the September quarter, as opposed to the five-year September quarterly average of 32%.

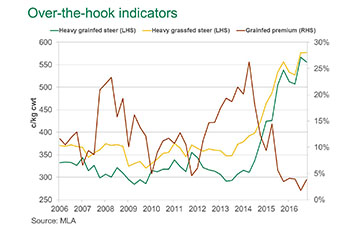

With a greater proportion of grainfed beef than usual, combined with an A$ that’s generally strengthened this year and increased US competition in key markets like Japan, the over-the-hook premium for grain finished cattle over grass has diminished throughout 2016. In fact, the premium for 100-day heavy grainfed steers averaged only 2% above grassfed heavy steers for the September quarter. Interestingly, despite the aforementioned weaker demand signals, a common trend (illustrated below) is that when the cattle market strengthens, which is what occurred for the first nine months of 2016, the premium for grainfed cattle narrows to that of grassfed, and vice versa.

With a greater proportion of grainfed beef than usual, combined with an A$ that’s generally strengthened this year and increased US competition in key markets like Japan, the over-the-hook premium for grain finished cattle over grass has diminished throughout 2016. In fact, the premium for 100-day heavy grainfed steers averaged only 2% above grassfed heavy steers for the September quarter. Interestingly, despite the aforementioned weaker demand signals, a common trend (illustrated below) is that when the cattle market strengthens, which is what occurred for the first nine months of 2016, the premium for grainfed cattle narrows to that of grassfed, and vice versa.

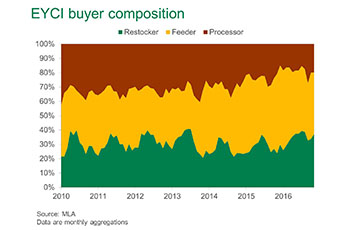

Feeder cattle remain a very expensive input and the price of young cattle is still outpacing that of grainfed cattle. Restockers have been the primary price drivers of young and store cattle since winter and early spring, but lot feeders are purchasing the majority of young cattle through saleyards.

Feeder cattle remain a very expensive input and the price of young cattle is still outpacing that of grainfed cattle. Restockers have been the primary price drivers of young and store cattle since winter and early spring, but lot feeders are purchasing the majority of young cattle through saleyards.

Indications of what to expect for the number of cattle on feed in the December quarter of 2016 are that numbers may have stabilised with the September quarter, with over-the-hook grainfed price premium increasing during the past six weeks. This is the first time the downward trend has been reversed since the first quarter of 2016, when numbers on feed started declining from record highs. For perspective, it should be noted that the September quarter numbers on feed are in fact very close to the long-term average.

For further information and analysis, please see the September quarter lotfeeding brief

To subscribe to the quarterly lot feeding brief or any of MLA’s market information publications, email: marketinfo@mla.com.au