Trade lamb prices remain volatile

04 May 2022

National trade lamb prices have been easing since August last year, when they hit a record high of 951.02¢/kg cwt. They hit their lowest price since October 2018 at the beginning of last month, when they dropped to 765.8¢/kg cwt. Since then, prices have remained quite volatile.

WA and SA trade lamb prices

Within individual states, prices have been jumping around for some time.

SA prices have been volatile since the beginning of the year, jumping from week to week depending on what sale is going ahead. This week, Naracoorte has been trading at a 28¢ premium on the state average, while the SA Livestock Exchange has been trading under the state average by 34¢. With both saleyards having similar throughput, this fluctuation in price can impact the state averages significantly.

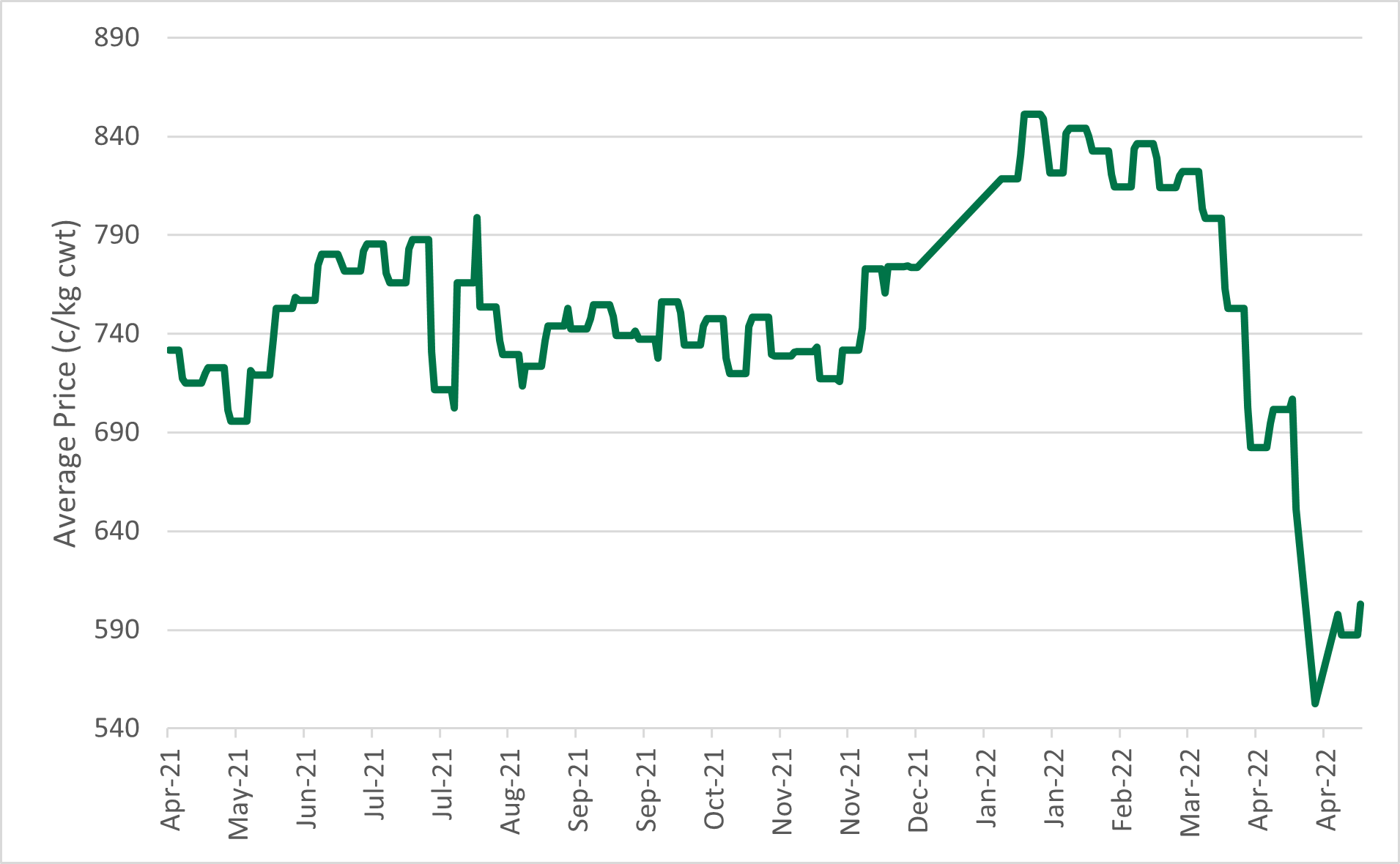

Meanwhile, WA prices have softened considerably since the beginning of the year. Trade lamb prices in the state are currently at 603¢/kg cwt, trading at a 23% or 182¢ discount to average daily prices year-on-year. Prices eased 269¢ between March and April, strengthening a little going into May. The graph below shows the movement in WA trade lamb prices over the last year.

Trade lamb prices in both WA and SA have been operating under the national average, with the average trade lamb price in WA being 175¢ under the national average. Throughput for these states have been extremely low for trade lambs, which has caused the greater volatility in the indicator. This was especially felt throughout April, with the public holidays resulting in softer yardings as expected.

Impact of quality and buying regions

Quality and buying regions have greatly influenced the prices for lambs.

Mixed qualities and varied rainfall experienced recently have impacted yardings and the ability for the lambs to meet trade lamb specifications. Forward contracts continue to deliver large volumes for processors, while saleyards are being utilised for most processors as an avenue to access the remaining numbers to fill orders.

Important to also note is that there has been a stronger demand for trade lambs in the Central West and Southern Slopes of New South Wales. CTLX Carcoar, Forbes, Dubbo and Cowra have consistently operated at a premium to the national price, accounting for 27% of total trade lamb yardings nationally.

Heavy lambs

Heavy lamb yardings nationally have been six times greater than the current trade lamb yardings, highlighting the softening in throughput.

Good rainfall in key producing areas and higher prices for heavy lambs at the end of 2021 and the beginning of 2022 has incentivised producers to put on more weight at a cheaper price with more feed on the ground.

Tight seasonal seasonal supply and the lack of demand from processors has also caused the prices for trade lambs to ease.

Looking back, moving forward

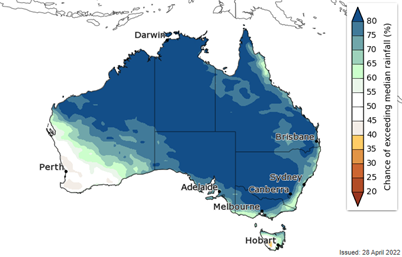

The Bureau of Meterology (BOM) has predicted higher than average rainfall in the coming months across the nation.

Current National Trade Lamb Indicator (NTLI) prices are operating at a 2.5% premium to the daily five-year average price back to 2017. This demonstrates that the current trade lamb market is still in positive territory compared to long term averages, even though a significant lack of supply is available in the current market.

As we move past the consecutive short weeks and predicted above average rainfall for many regions incentivising restockers, prices, yardings and demand for trade lambs could shift as the year goes on.