Grassfed beef opportunities in the US market

11 July 2017

The US is the largest beef protein market in the world, with 97% of domestic production estimated as being grainfed or produced through concentrated animal feeding operations.

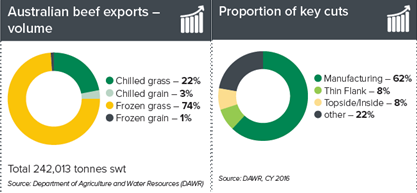

Australia’s beef trade into the US is a largely complementary trade, with more than 95% of the volume being grassfed beef. More than 60% of the trade in volume is manufacturing beef, usually used for grinding into hamburgers and is predominantly a frozen trade.

In recent years, the proportion of Australian chilled beef exports of total exports has increased significantly, most of this being premium grassfed cuts, even with the decline over the last 18 months due to tight Australian supplies. For example, last year 25% of the volumetric trade into the US was chilled beef, representing just over a third of the dollar value of the total trade (at just over $1.8 billion)3.

Size of the US grassfed beef market

The US grassfed beef market is estimated to be worth about $5.3 billion in retail and foodservice sales, representing about 4% of the total US beef market. However, most of the grassfed component is unlabelled and conservatively the labelled grass fed component is worth about $1.3 billion, indicating many consumers are eating grass fed beef without knowing1.

Much of the grassfed beef is mixed with fattier domestically produced beef to make hamburgers but increasingly US consumers are seeking out grassfed beef due to the perceived health benefits.

According to a Stone Barns Center for Food & Agriculture report, retail sales of labelled fresh grassfed beef grew from $22.6 million in 2012 to nearly $363 million in 2016, doubling every year2.

Despite the market confusion over the definition of grassfed, and the plethora of labelling claims that intersect, it demonstrates that many US consumers are willing to pay the average 70% premium at retail on conventional beef.

The appetite for grassfed beef

The latest Global Tracker research conducted by MLA indicates that despite the price premium, 70% of consumers of grassfed beef believe it is worth the extra cost. On the flip side, of those that have not bought grassfed beef, 40% have not purchased grassfed beef as it is too expensive.

The research also revealed that awareness of grassfed beef is high with US consumers, where 78% of people are aware of the product.

![]()

Source: MLA Global Consumer Tracker 2017. Q - Which of the following types of beef are you aware of?

Nine out of ten consumers who were aware of grassfed beef, and surveyed as part of the Global Tracker, stated they would consider buying the product.

Domestically produced grassfed beef has the highest levels of awareness in the US, but Australia performs strongly compared with other importing countries, such as NZ, Uruguay, Mexico and Canada.

Purchase drivers

MLA research demonstrated that the number purchase driver of Australian grassfed beef is freshness. Though price is still a critical issue, for Australian premium product the target consumer has a high income of more than $115,000 and is aged between 18 and 49 years.

These consumers are also attracted to the health benefits of eating grassfed beef, with 63% of consumers believing it is better for the animals, and 50% considering it better for the environment.

Compared to the global average, US consumers are more likely to purchase high quality steak (38% vs 28% of the last five purchases were all high quality cuts), indicating that the biggest economy in the world still represents great opportunities for Australian exporters, particularly for premium chilled vacuum packed product.

Bottom line

These insights indicate that Australian exporters of branded grassfed beef would be well placed to emphasise the freshness of their product, and highlight animal welfare and environmental sustainability messages on the packaging.

The 2017 MLA Global Consumer Tracker will be available in October 2017.

More information

Rob Williams

rswilliams@mla.com.au

- Stones Barnes Report “ The market potential for US Grassfed Beef”, April 2017

- Stone Barns Center for Food & Agriculture report uses Nielsen data

- MLA North America Beef Market snapshot