Strong demand for grainfed product in 2017

15 December 2017

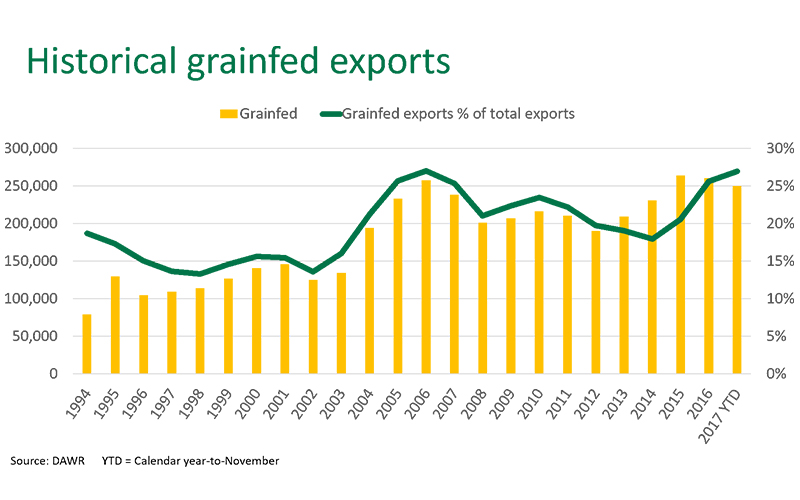

Australian grainfed exports are expected to reach an all-time record, surpassing that of 2015, if December grainfed exports are in line with the current calendar year monthly average (22,701 tonnes shipped weight).

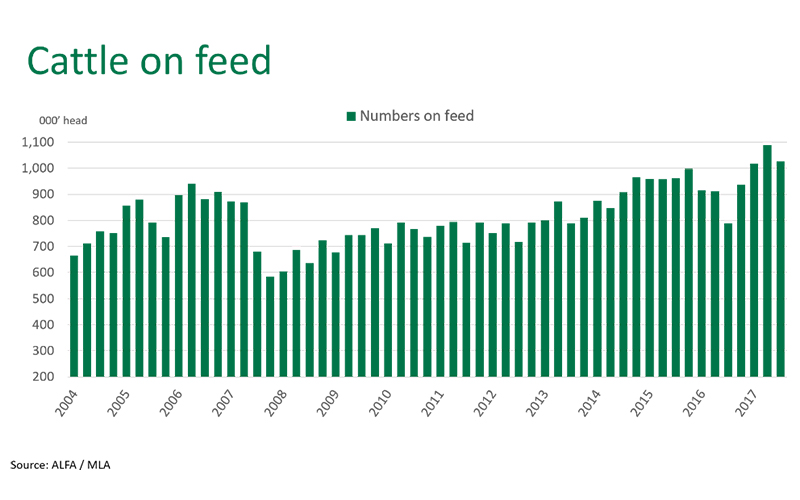

In 2017 we have seen record numbers of cattle on feed in Australia, which has resulted in more than one million head on feed reported in all quarters (March, June and September). This growth in grainfed exports has been supported by heightened investment in the lot feeding sector, favourable grain prices and growing global demand for high quality grain product.

Grainfed exports as a percentage of total exports currently stands at 27%, equal with 2006. Since then, grainfed exports have been driven by robust demand from Japan and Korea,. An increase in the number of cattle on feed over the same period indicates a switch in order to service grainfed beef demand.

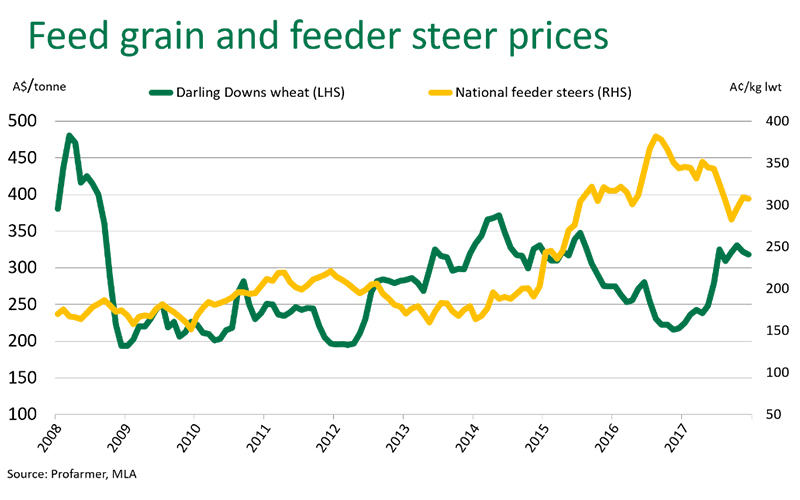

High cattle prices and cheaper grain prices at the start of 2017 incentivised lot feeders to retain cattle for longer, while dry winter conditions across much of Queensland saw greater numbers placed on feed - with the effects now being realised in export markets. All of these factors have seen feedlot turn-off as a percentage of total adult cattle slaughter total 36% for the calendar year-to-September.

Export markets

Grainfed exports to Japan for the calendar year-to-November are 11% higher year-on-year at 131,371 swt– the principal recipient of Australian grainfed beef. High domestic Wagyu prices, strong demand for high quality grainfed product and improving tariff barriers has underpinned the increase.

When comparing against the five-year average Australian grainfed exports have seen considerable growth in some of the major grainfed markets.

- Japan increased 12% compared to the five-year average.

- Grainfed exports to Korea have lifted 35% - albeit down slightly year-on-year to 47,880 tonnes swt, as greater US competition challenged exports.

- China has moved 60% higher than the five-year average to 23,908 tonnes swt, driven by a growing high end foodservice sector.

Domestic outlook

Grain prices, the price paid for cattle to induct into the feedlot and price received at processing are all fundamental factors which affect lot feeder profitability. A decline in cattle prices has been partially offset by grain prices moving in the opposite direction. Albeit the lift in feed grain prices in 2017 and historically high cattle prices will likely see numbers on feed drop back below the one million head mark, particularly as cattle supplies remain tight as the herd remains in rebuild.

The national saleyard feeder steer indicator is currently reported at 307.51¢/kg lwt. Ex-Darling Downs wheat prices have moved 41% higher since the turn of the year, to A$318/tonne, as the Australian winter crop was hit by below average rainfall.

Global demand for grainfed product however, remains robust and will see Australian grainfed production supporting exports in the future.