New ABS data highlights crucial role of red meat in national commodities

19 January 2023

Key points:

- Red meat and livestock industry generated over $25 billion in gross value last financial year

- Livestock slaughter and other disposals increased in 2021–22

- Cattle industry remains the highest in gross value within the livestock category

- Historically high cattle and sheep prices have contributed to this performance.

The Australian Bureau of Statistics (ABS) released its annual 2021–22 Value of Agricultural Commodities data this week, highlighting the crucial role the Australian red meat industry plays in national commodities.

The report identified growth across all sectors, including livestock herd numbers, livestock disposals and products. In the previous financial year, the red meat industry generated over $25 billion in gross value.

Livestock

Livestock slaughter and other disposals have continued to climb with a 12% increase in livestock disposals and a 7% increase in livestock products from the previous financial year.

Red meat production (slaughter and other disposals of cattle and sheep) made up to 80% of the gross value. There was a marked increase of 14% in both categories from 2020–21.

Key figures include:

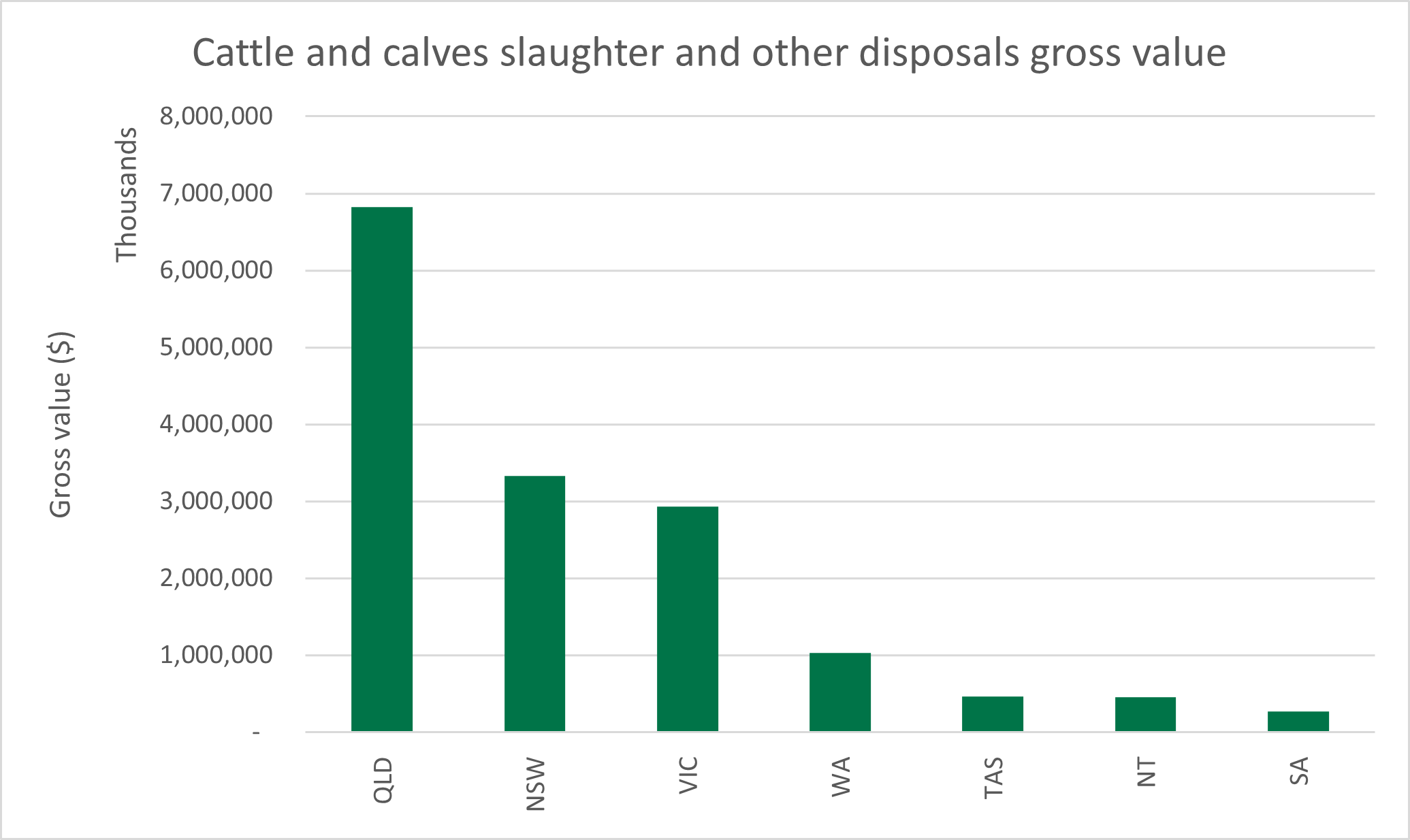

- $15.3 billion gross value came from cattle and calves

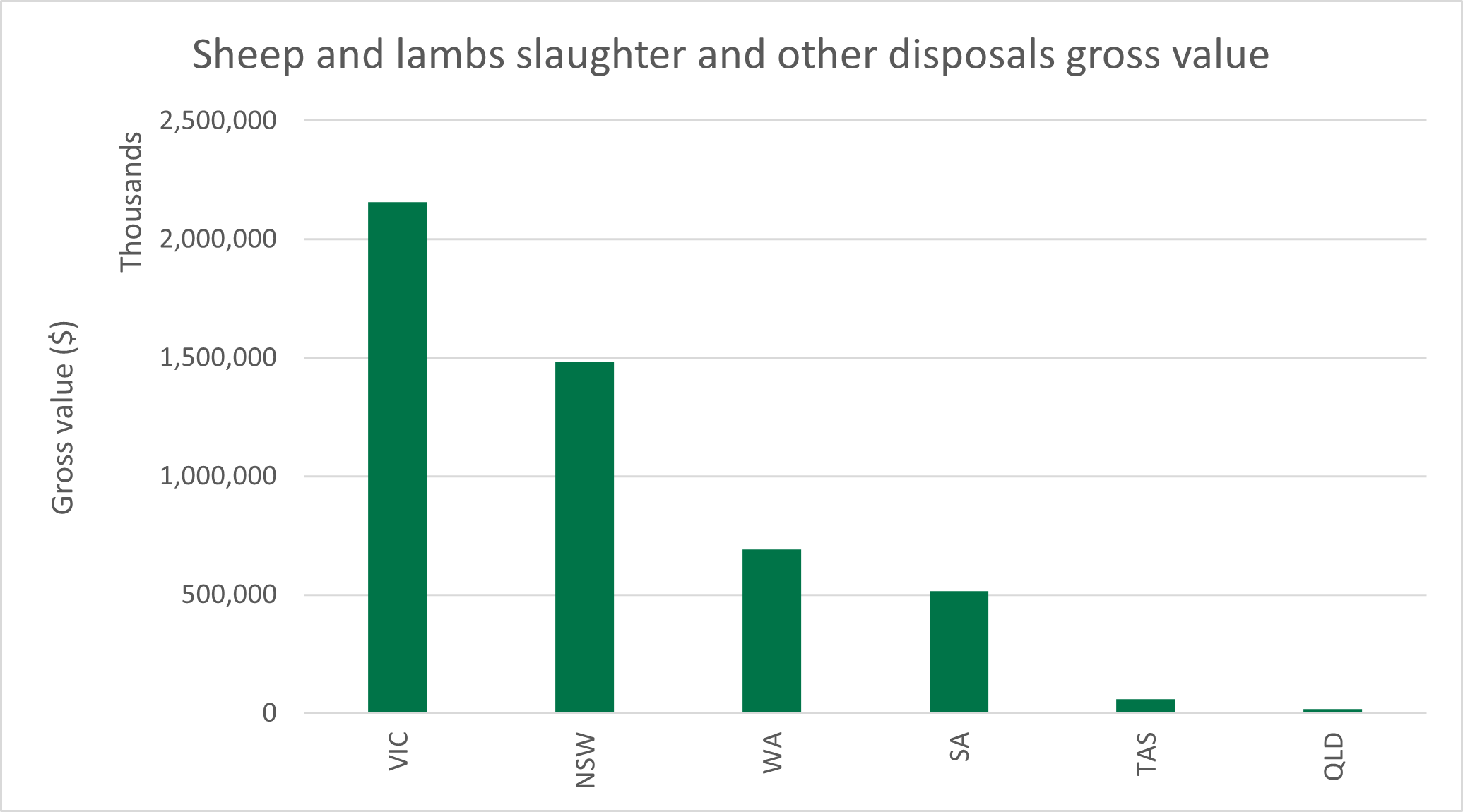

- Just under $5 billion came from sheep and lambs

- Queensland had the highest gross value for cattle and calves at $6.8 billion

- Victoria created $2.2 billion in revenue for sheep and lambs.

Showing the strength of the sector, over the past five years cattle and calves have consistently out-performed other livestock products. Strong prices in the red meat industry have also aided in increasing gross values.

Historically strong cattle prices throughout 2022 helped increase the gross values as the rebuild gained traction in the north and strong retail prices also supported the industry.

Retail

Retail prices for lamb in Q2 of 2022 finished 7% higher than the same time the previous year.

Co-products have gained increasing interest in the last year and have shown to provide much value to the industry.

The January Meat & Livestock Australia (MLA) co-products report, released this week, identifies new trends across the sector:

- Cheekmeat, which was hitting record highs in 2022, has softened by 19%. This is off the back of inflated prices and still 17% above prices from last year.

- Blood meal prices have softened 16% with an easing in fertiliser prices.

Grains

Combined cereal and non-cereal crops prices, such as wheat, barley, oats and canola, continued to give a high gross value of $30.1 billion. This reflects the trend of the past two years in grain prices. Large increases were seen in canola with high prices in oil, and wheat after reduced supply on the international market.