Restocker yearling steer to heifer premium reaches highest level on record

15 June 2023

Key points:

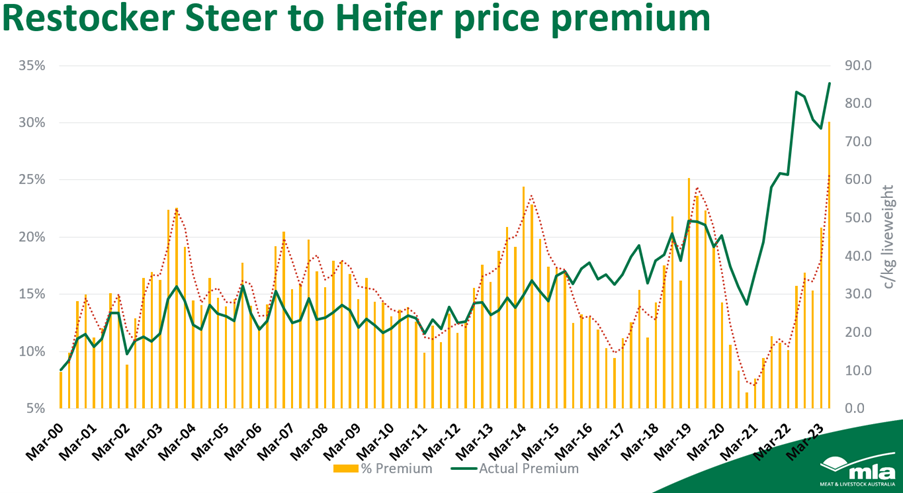

- In Q2 2023, the restocker yearling steer to heifer premium reached its highest level on record at 30% or 85¢/kg liveweight (lwt).

- This price dynamic indicates numbers of breeding females on-farm is significantly higher than it has been in a long time, reducing demand and therefore heifer prices.

- Weather and the cattle cycle will continue to determine how this premium fluctuates moving forward.

In late April, MLA’s Market Information team forecast that the restocker yearling steer to heifer premium would widen further moving into winter. In Q2 2023, the premium reached its highest level on record on a quarterly basis.

The discount heifers are currently receiving over their male counterparts can be attributed to:

- The past three years driving the most intense national herd rebuild since the 1990s

- With the cattle cycle in a growth phase, on-farm numbers of breeding females are well above long-term averages

- Demand for future breeding females in the saleyards has diminished intensely in 2023, driving prices down.

Price

In both actual and percentage terms, the Q2 premium for steers over heifers was the highest on record at 30% or 85¢/kg lwt (Figure 1).

Figure 1: Restocker steer to heifer price premium

Of all National Livestock Reporting Service (NLRS) price indicators, the Restocker Yearling Heifer indicator has seen the most significant fall in prices this year (at the time of writing).

When examining the price premium for steers over heifers, it naturally mimics the cattle cycle and, due to the intensity of the rebuild, tightened to its lowest level on record in Q4 2020 in percentage terms.

Following this tightening, it has continually widened as female numbers on-farm increased swiftly, both through retention of females on-farm and intense purchasing of heifers in the market.

There are several insights that can be drawn from this continuation of the widening in the premium:

- The continued softening of the restocker heifer price in 2023 indicates more of the younger females retained during the rebuild are now entering reproductive age.

- The reintroduction of trading and background buyers has provided significant support for the restocker steer price this year.

- Ample ground water, bodies of feed and attractive cattle prices have meant these buyers played a role in supporting the steer market.

- This is despite national supply of restocker-bought yearling steers being 20% or 17,000 head higher than 2022 year-to-date volumes.

- Thus, with a firmer steer price and continuing softening heifer price, the premium widens.

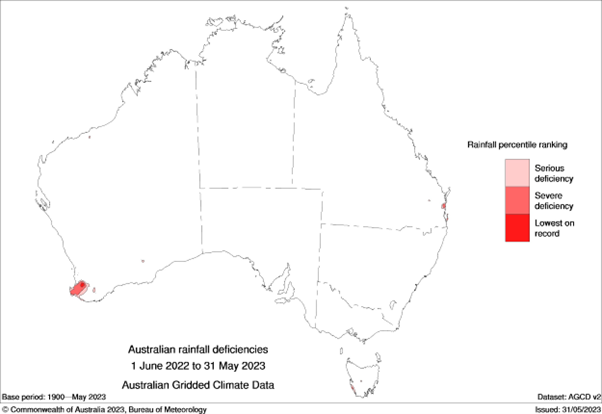

Furthermore, Figure 2 from the Bureau of Meteorology indicates no areas of significant scale in Australia are currently considered to be in drought.

Figure 2. Australian rainfall deficiencies (12 months to 31 May 2023)

As the restocker yearling steer to heifer premium operates cyclically in line with the cattle herd, it can be concluded that significantly reduced demand for restocker heifers suggests numbers of breeders on-farm are the highest they’ve been in a decade or more.

Looking ahead

As the MLA Market Information team identified in a previous article which forecast the restocker steer to heifer premium to widen further, the key determinants of where this premium tracks are cyclicality of the cattle cycle and the weather.

Already this week, prices have lifted for restocker heifers as rain brought confidence to the market while steer prices conversely declined as a strong uptick in supply placed pressure on price.

Over the coming months, this premium may continue to widen as 2022-drop heifer calf supply (surplus to requirements on-farm) places downward pressure on prices when they hit the market later this year and early 2024.

Regionality in the rebuild of herd numbers will see this premium adjust, with Queensland’s rebuild continuing (while other states have already rebuilt) – this may provide support for improved heifer pricing performance at a regional or state level.