Weekly cattle and sheep market wrap

24 March 2023

Key points:

- Subdued buyer activity and price fatigue has caused pricing indicators to ease.

- Some indicators have been impacted more than others as supply increases.

- Sheep slaughter has increased significantly after the Victorian public holiday and with easing mutton prices.

Cattle

National cattle yardings lifted to 49,273 head this week after last week’s wet weather reduced numbers at the saleyards.

In Roma, yardings increased to 6,800 head and restocker demand eased in restocker yearling steers and heifers and across all weight ranges.

The Western Young Cattle Indicator (WYCI) is trading at a premium to the Eastern Young Cattle Indicator (EYCI).

Muchea saleyard prices for young cattle improved 6¢ week-on-week, whereas Mount Barker eased 45¢, causing the indicator to soften 42¢ to 728¢/kg carcase weight (cwt).

The EYCI currently sits at 669.10¢/kg cwt with Dalby prices easing 62¢ week-on-week.

All cattle indicators eased this week. The Heavy Steer Indicator eased 9¢ week-on-week, but prices for extra heavy cattle (600–750kg) were the only weight range to improve in price for the indicator demonstrating the demand from buyers for cattle with weight. Another consideration in the easing of the indicators is price fatigue in the market.

Some feeder buyers that bought cattle at much higher prices are having to sell those numbers for less than expected. Processors, who can get stock cheaper while being presented with more choice, can be more selective in their buying.

Sheep and lamb

Sheep and lamb yardings remained firm this week. Varied quality at markets such as Wagga Wagga impacted buyer activity.

Some processors are still working through stock secured in direct contracts with reports of some facilities heavily booked. This has reduced the sense of urgency for stock in the market, contributing to the easing of prices.

The Trade Lamb Indicator eased 11¢ week-on-week with some key contributors trading under the national average. The top contributor to the indicator, Hamilton, traded 43¢ under the national average. Processor sale proportion also came back for the indicator, demonstrating activity in the market.

Slaughter

This week sheep and lamb slaughter moved in opposite directions.

Sheep slaughter made an increase of 31% week-on-week, heightening the year-on-year change to nearly 73,000 head.

In contrast, lamb slaughter has eased to 343,659 head, 10,000 head below this time last year. Recent easing in prices has occurred more sharply for the Mutton Indicator than for heavy lambs, which has been able to maintain a relatively stable price comparatively.

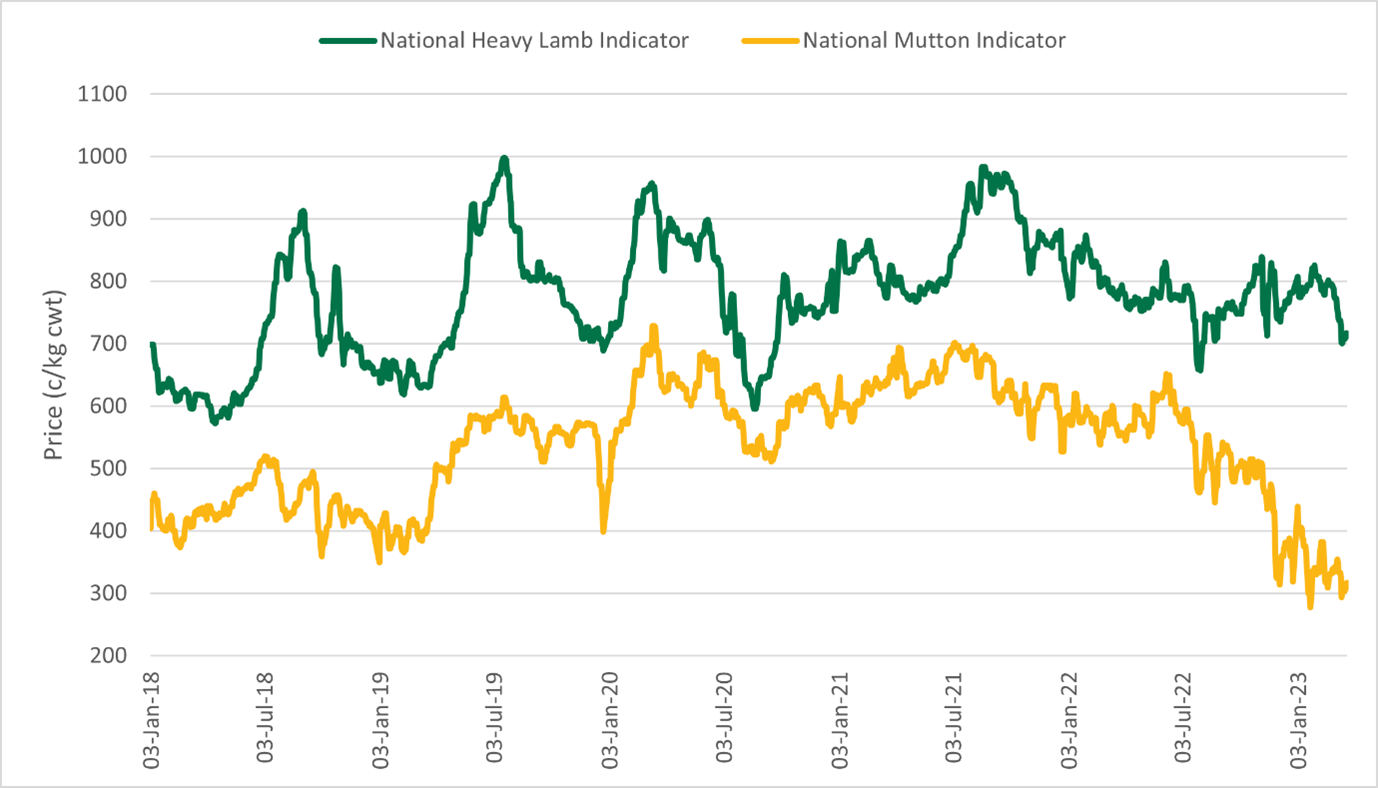

Since June 2022, the Mutton Indicator has eased 51% to 317.14¢/kg cwt whereas the Heavy Lamb Indicator has only eased 11% (Figure 1).

Figure 1. The National Heavy Lamb Indicator vs the National Mutton Indicator

Source: MLA

Cheaper mutton on the market is allowing processors to purchase more sheep for slaughter.

The Victorian Labour Day public holiday has dampened sheep and lamb slaughter in previous weeks but is now recovering.

Cattle slaughter remained firm this week at 108,693 head.

Markets update

Blackall did not run this week due to continued rainfall in supply areas and flooding conditions in central and northern Queensland.

The March co-products report was released on Monday, showing the impact of increased supply and slaughter on price.