US beef prices rising as slaughter remains at record highs

23 February 2023

Key points:

- The American cattle herd has been in a destock phase since 2019, boosting production and exports.

- It is very likely that the herd will enter a rebuild phase in the next 18 months, which will limit supply and boost demand.

- The expectation of reduced supply has led to a shift in the American beef market, pushing prices up and increasing interest in imports.

Expected declines in American beef production are pushing prices up, while slaughter rates remain at historically high levels.

American production

As discussed in the recent Meat & Livestock Australia (MLA) January Cattle Projections, dynamics in the US cattle herd are an important driver of cattle prices in Australian saleyards. As a competitor of Australian beef, the US market subsequently affects the Australian market.

For the past several years, the US has been in a technical destock. In January, the United States Department of Agriculture (USDA) released data estimating that the herd had shrunk by 3% to 89.3 million head. At the same time, US slaughter rates are likely to soften later this year, and an end to the drought in the US’s south and south-west regions would be likely to drive an aggressive herd rebuild, limiting supply and increasing demand (and prices) for Australian cattle and beef.

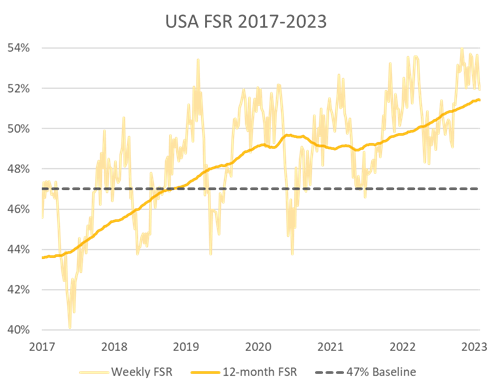

Slaughter rates

In the first five weeks of 2023, US slaughter stood at 3.16 million (unchanged from last year). Cow and bull slaughter is down slightly, but the female slaughter rate for the year to date is 53%, well above the 2022 rate of 51%. This indicates that the US destock still has some way to go but that supply is likely to remain strong in the short term. The cattle cycle has not yet moved out of a destock.

Impact on price

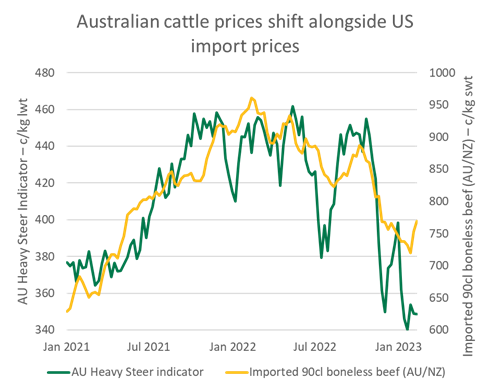

Regardless of the actual slaughter rate, the US destock/Australian rebuild dynamic has led to beef and cattle prices in the US rising, despite the short-term supply glut.

As Steiner Consulting noted in their weekly US Market Update for MLA, ‘talk of tight beef supplies has dominated the market for the last six months, and recent gains in the value of domestic lean beef have made that risk all too real for buyers.’

As such, after falling through the second half of 2022, the US 90 chemical lean (cl) imported beef indicator stabilised in December and has risen 5% in 2023.

Generally speaking, the 90cl indicator fluctuates less than Australian cattle prices, but over time the 90cl can influence the ‘trend’ of the overall market. The rise in the 90cl suggests that global demand for beef is high and that buyers (at least in the American market) are willing to pay more to ensure supply.

The end of lockdowns in China appears to have been a positive for beef imports and better-than-expected economic forecasts have given market participants more confidence in the market.

Brazil’s export ban

Shifts outside the US are also likely to impact overall demand. On Thursday 23 February, Brazil suspended beef exports to China after an atypical case of bovine spongiform encephalopathy (BSE) was detected in the northern state of Para. The last time a case of BSE was detected in Brazil was in September 2021, leading to a four-month suspension of exports. This did not have an appreciable impact on Australian beef prices as Australian exports to China were limited, and most Australian beef is exported to markets that Brazil does not have market access to.

Since the suspension in 2021, Brazilian exports to China have grown to be the largest single trade flow in the world, affecting the global commodity price. In 2022, Brazil’s exports to China were over 1.2 million tonnes – 42% higher than 2020 and 59% of Brazil’s total exports.

Depending on the length of the import ban, some of Brazil’s beef is likely to be exported to countries without export controls on BSE, but some is likely to be redirected to the domestic market, which has seen domestic consumption steadily fall as exports to China grow. As that beef will effectively be taken out of the global trade, this import ban may result in a drop in global supply, depending on how long imports are restricted.

Looking ahead

Buyers on the global market are likely to be mindful of supply as a key variable throughout 2023. This recognition is good for Australian beef, which is well placed to deliver high quality product as volumes from the US decline.